As the UK gears up for the general election, many are pondering its potential impact on various sectors, including the housing market. Historically, elections have been periods of uncertainty, often causing a temporary pause in market activity. However, this year, the landscape appears different. With no significant policy changes anticipated and a possible boost from the first interest rate cut, the housing market may not experience the typical election-related slowdown.

Election Fears: Unfounded This Time?

In past elections, the fear of substantial policy changes, often led to a hesitation in the housing market. Buyers and sellers would adopt a wait-and-see approach, causing a noticeable dip in market activity. However, this election is not accompanied by the spectre of significant policy shifts that could directly impact the housing market. Without the looming threat of major changes, market participants are less likely to hit the pause button.

Seasonal Patterns in the Housing Market

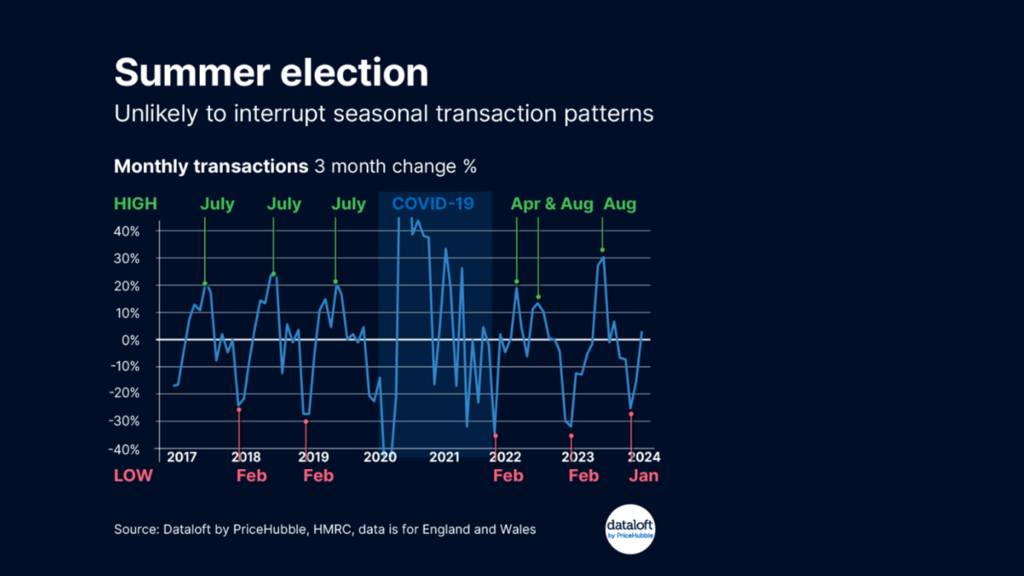

Understanding the housing market’s seasonal patterns is crucial in predicting its behaviour during the election period. Historically, the market sees decent activity in July. This is largely due to the delay from the agreement of sale to completion, which typically spans a couple of months. Consequently, the busiest period for transactions tends to be in April and May.

As we approach the election, it’s important to note that these seasonal patterns often override other influences. The anticipation of summer sales can drive activity regardless of political events. Therefore, even with an election on the horizon, the housing market is likely to follow its usual seasonal trends.

The Pipeline of Deals: A Positive Outlook

Current data suggests there is no real threat to deal activity in the pipeline. The number of transactions in progress remains robust, indicating confidence in the market. This confidence is partly bolstered by the anticipated interest rate cut, which is expected to provide a significant boost.

Interest rate cuts typically lead to lower mortgage rates, making borrowing more affordable for buyers. This increased affordability can stimulate demand, encouraging more transactions and supporting market activity. The expected rate cut, is likely to counterbalance any potential election-related hesitation.

The Influence of Interest Rates

Any change to interest rates could have a more substantial impact on the housing market than the election itself.

Expert Insights and Predictions

According to Dataloft PriceHubble and HMRC data for England and Wales, the housing market is set to remain resilient despite the election. Analysts suggest that the stability provided by the expected interest rate cut will outweigh any uncertainties brought about by the election.

Dataloft, a property market data specialist, echoes this sentiment. They argue that the absence of major policy changes reduces the likelihood of market disruption. Instead, the primary influence on market activity this year will be economic factors such as interest rates.

Stay Informed and Take Advantage

For those considering buying or selling property, it’s important to stay informed about market trends and economic indicators. While the election may introduce a degree of uncertainty, the underlying factors point towards continued market stability.

At Belvoir, our team of expert estate agents is here to help you navigate the housing market, offering insights and advice tailored to your needs. Whether you’re looking to buy, sell, or simply explore your options, we are committed to providing you with the support and information you need to make informed decisions.