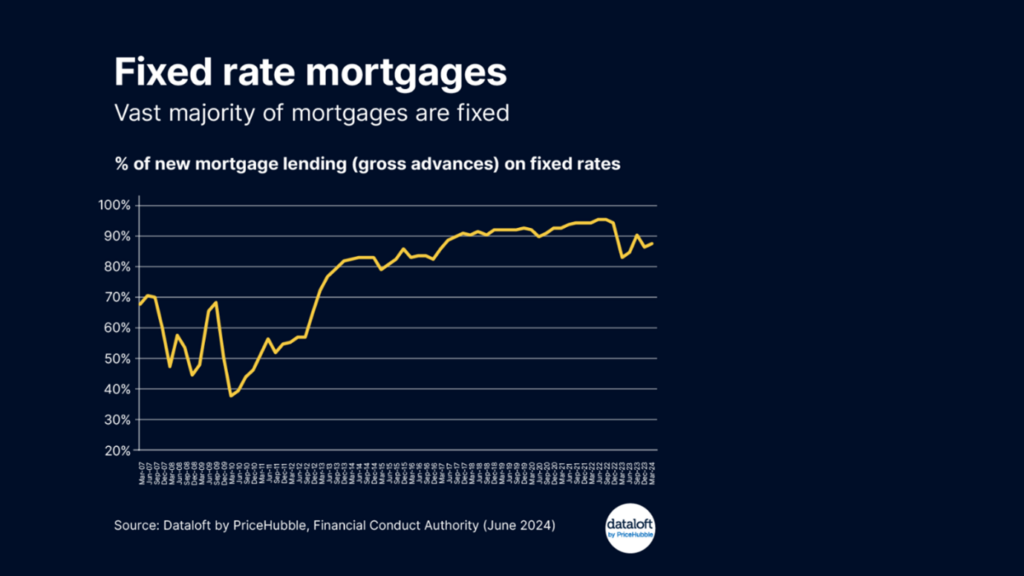

The landscape of the UK mortgage market has seen many shifts over the years, but one constant remains: the popularity of fixed-rate mortgages. Despite a slight dip in their dominance, fixed-rate mortgages continue to be the preferred choice for many borrowers, offering a sense of stability and predictability in a fluctuating financial environment. According to recent data from Dataloft PriceHubble, these types of mortgages maintain their appeal, even as we anticipate a potential drop in interest rates this August.

The Certainty of Fixed-Rate Mortgages

For many mortgage borrowers, the allure of fixed-rate mortgages lies in their reliability. Fixed-rate mortgages allow borrowers to lock in an interest rate for a specified period, typically ranging from two to ten years. This ensures that their monthly repayments remain consistent, regardless of fluctuations in the Bank of England’s base rate or other economic factors. In a world of financial unpredictability, this certainty is invaluable.

Data from the Financial Conduct Authority, analysed by Dataloft PriceHubble, shows that despite a slight retreat from their peak, fixed-rate mortgages are still the first choice among borrowers. In September 2022, the proportion of new mortgages being taken out on fixed rates hit a high of 95.5%. While this figure has since declined slightly, the preference for fixed-rate deals remains strong. This shift suggests that while some borrowers are exploring variable or tracker rate options, the majority still favour the stability that fixed rates offer.

Historical Perspective: Fixed Rates vs. Variable Rates

To truly appreciate the current landscape, it’s important to consider the historical context. Before the Global Financial Crisis of 2007-2008, a much lower proportion of mortgage lending was on fixed rates. Borrowers were more inclined to opt for variable rates, which often started lower than fixed rates but came with the risk of rising costs if interest rates increased. The financial turmoil of the crisis shifted borrower behaviour dramatically, with many seeking the safety and predictability of fixed rates.

This trend has largely persisted, with fixed-rate mortgages becoming the norm rather than the exception. The financial instability and economic uncertainty of recent years have reinforced this preference, as homeowners and prospective buyers look to shield themselves from potential interest rate hikes.

Barclays Leads the Way in Rate Cuts

In a significant move, Barclays Bank recently cut several of its key mortgage rates, ahead of the anticipated Bank of England rate cut in August. This proactive step by one of the UK’s leading lenders highlights the dynamic nature of the mortgage market and the ongoing competition among banks to attract customers.

Barclays’ decision is seen as a strategic move to capture market share before the expected rate reduction by the Bank of England. By offering lower rates now, Barclays positions itself as an attractive option for borrowers looking to secure favourable terms before the broader market adjusts. This move could signal the beginning of a trend, with other major lenders likely to follow suit in the coming weeks.

Forecasted Drop in Interest Rates

The forecasted drop in interest rates by the Bank of England is a critical factor in the mortgage market. Lower interest rates generally make borrowing cheaper, encouraging more people to take out mortgages and potentially boosting the housing market. For existing mortgage holders, a rate cut can reduce monthly repayments if they are on a variable rate or if their fixed rate period is coming to an end and they are looking to remortgage.

This anticipated rate cut is expected to sustain the popularity of fixed-rate mortgages, as borrowers will be eager to lock in these lower rates for the future. The timing of Barclays’ rate cuts suggests that borrowers might benefit from acting swiftly to take advantage of the currently favourable conditions.

The Enduring Appeal of Fixed-Rate Mortgages

Despite the slight decline from their peak, fixed-rate mortgages remain a cornerstone of the UK housing market. Their enduring popularity can be attributed to the financial security and peace of mind they offer in an ever-changing economic landscape. With a potential interest rate cut on the horizon, the appeal of fixed-rate deals is likely to remain robust, as borrowers seek to secure stable and affordable repayment plans.

For those considering a new mortgage or remortgaging, now is an opportune time to explore fixed-rate options. The recent rate cuts by Barclays and the expected Bank of England decision in August present a window to secure attractive mortgage terms.

The information provided in this article is for general informational purposes only and does not constitute financial, investment or mortgage advice. The information provided in this article is accurate at the date of publishing. Any reliance you place on such information is strictly at your own risk. We strongly recommend that you seek professional advice before making any financial decisions.