The UK property market is continuously shaped by societal shifts and one of the latest trends affecting buyer preferences is the increasing return to working in the office. As the post-pandemic world continues to evolve, companies in the UK are encouraging more employees to return to their desks and this shift is having a noticeable impact on the housing market. In this article, based on information from Dataloft by PriceHubble we will explore how this change in working habits is influencing buyer behaviour, while also providing an update on the latest mortgage changes.

A Shift Back to the Office

After years of remote and hybrid working arrangements, there has been a notable increase in employees returning to physical offices. Many companies across various sectors have started to roll back full-time remote working policies, either to foster collaboration, increase productivity or simply to ensure a more traditional working environment.

This return to the office is having a significant impact on where and how people want to live. During the pandemic, there was a surge in demand for properties located in rural and suburban areas, as buyers sought more space and a better work-life balance. Homes with larger gardens, spare rooms for home offices, and proximity to nature were particularly sought after.

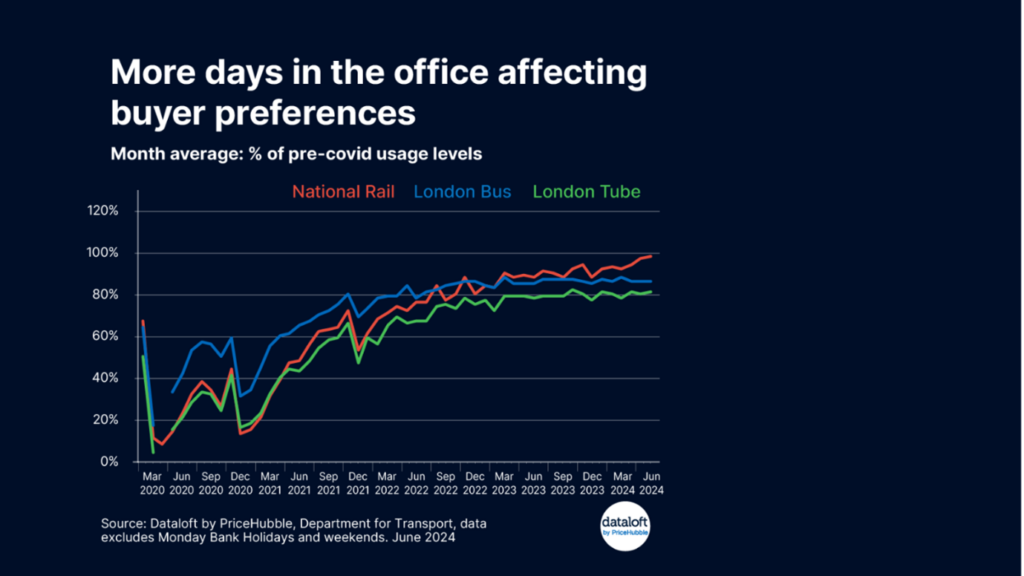

However, with more employees now required to commute, there is a renewed interest in properties located closer to major business hubs and transport links. Commuting times and accessibility to workplaces are becoming key considerations once again for prospective buyers. As a result, urban areas and locations with good transport links are regaining popularity among homebuyers.

Mortgage Rates

After five consecutive months of increases, both two- and five-year fixed-rate mortgage deals have seen a decline. According to Moneyfacts, the average two-year fixed rate dropped to 5.77%, while the five-year fixed rate now stands at 5.38%. These decreases of 0.18% and 0.15% respectively between July and August represent a significant reprieve for buyers who were previously facing escalating costs.

This drop in mortgage rates can be attributed to broader economic trends. Notably, the Bank of England implemented a 0.25% base rate cut, marking the first such reduction in over four years. With inflation showing signs of easing, and economic growth remaining steady, many financial experts anticipate further reductions in mortgage rates in the coming months. According to market forecasts, we could see the base rate drop to 4.67% by the end of 2024.

For buyers, this presents an excellent opportunity to secure a mortgage deal at a more favourable rate, reducing monthly repayments and making home ownership more affordable. This is especially timely for those re-evaluating their living arrangements in light of a return to the office.

Buyer Preferences: What’s Changing?

As mortgage rates become more attractive and the return to the office reshapes priorities, the type of homes buyers are looking for has also begun to shift. Previously, the pandemic-driven demand for larger homes in rural areas was primarily driven by a need for space to accommodate remote working. As more employees head back to the office, urban living is once again in the spotlight.

City-centre properties, especially those within walking distance of offices or with easy access to public transport, are seeing increased demand. Flats and smaller homes, which may have been less appealing during the height of remote working, are becoming desirable again as the need for proximity to work outweighs the desire for more space.

At the same time, some buyers are still seeking a balance between work and personal life. As hybrid working remains an option for many, suburban areas with good transport connections are also seeing renewed interest. These locations offer a compromise—allowing for easier commutes while still providing a quieter, more spacious living environment than city centres.

There is still a considerable demand for homes that cater to occasional remote working. Properties with a spare room or dedicated home office space remain a priority for many buyers, as flexible working arrangements are expected to continue in some form. However, the emphasis has shifted from needing full-time remote workspaces to more versatile living spaces that can accommodate a variety of needs.

How Commuting Is Affecting the Market

The return of commuting as a daily reality for many workers is playing a pivotal role in shaping buyer preferences. For the first time in several years, proximity to train stations, bus routes and major motorways is once again a critical factor in property searches.

This has led to a resurgence in the popularity of so-called “commuter towns,” which offer more affordable housing than city centres, but with convenient transport links for a smooth journey into the office. Towns and cities within an hour’s commute of major business hubs like London, Birmingham, Manchester and Leeds are seeing increased demand, as buyers prioritise locations that balance affordability with accessibility.

For estate agents, this means there is a growing opportunity to market properties in these areas, highlighting their connectivity and suitability for buyers who are navigating the return to regular commuting.

What Does This Mean for Buyers?

For prospective buyers in the UK, the current market offers a unique opportunity. With mortgage rates falling, and expected to decline further in the coming months, now is a good time to consider making a move. Whether you’re looking to purchase a home closer to your office or are seeking a balance between city living and suburban tranquillity, there are options to suit every buyer’s needs.

The return to working in the office has undoubtedly shifted priorities, but it has also opened new opportunities. Those looking to buy should take advantage of lower mortgage rates and the range of properties now available. Whether your priority is a short commute, access to green spaces or the flexibility to work from home, now is a good time to explore the housing market.