The UK property market is experiencing a notable shift towards cash purchases, a trend that is reshaping the landscape of home buying. According to recent data from Dataloft by PriceHubble, the proportion of cash buyers has increased significantly across the UK. This shift is driven by various economic factors, most notably the rising costs of mortgages, which have made cash purchases a more attractive option for many buyers. In this article, we explore the rise in cash buyers, regional variations and the implications for both buyers and sellers.

Increasing Prevalence of Cash Buyers

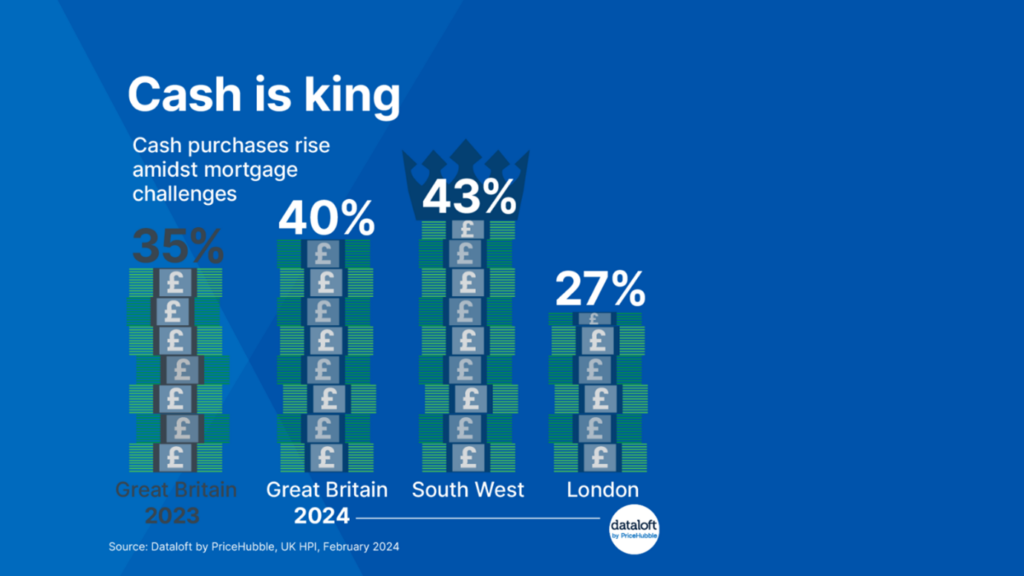

Cash buyers now account for 35% of property sales in Great Britain, up from 30% in the same month last year. This increase highlights a growing trend towards cash purchases, which offer several advantages in the current market. Cash buyers are not reliant on mortgage approvals, making their offers more appealing to sellers who seek a quicker and more certain transaction process. This trend is particularly beneficial in a competitive market, where mortgage affordability has become more challenging due to higher interest rates.

Regional Variations in Cash Purchases

While the overall trend indicates a rise in cash buyers, regional differences are quite pronounced. The South West of England boasts the highest proportion of cash buyers, with 43% of all sales being cash purchases, up from 35% a year ago. This region’s popularity among retirees and second-home buyers, who often have access to substantial equity, contributes to the higher percentage of cash transactions.

In contrast, London has the lowest share of cash buyers at 27%. Despite this, the capital has still seen an increase from 20% in the previous year. The high property prices in London mean that even with a lower percentage of cash buyers, the actual number of cash transactions remains significant. The ability to purchase without a mortgage is a considerable advantage in London’s competitive market, where buyers often face fierce bidding wars.

The Impact of Higher Mortgage Costs

The past twelve months have seen a marked increase in mortgage costs, largely due to rising interest rates. This has had a significant impact on affordability for many potential buyers who rely on mortgage financing. As a result, cash buyers, who are not affected by these increased borrowing costs, have gained a competitive edge. Sellers are more likely to favour cash buyers, as they can complete transactions more quickly and with greater certainty, avoiding the potential pitfalls of mortgage approvals falling through.

Advantages for Sellers

For sellers, the rise in cash buyers can be advantageous. Cash transactions tend to proceed more smoothly and swiftly, reducing the risk of sales falling through due to financing issues. This can be particularly appealing in a market where securing a timely and reliable sale is crucial. Cash buyers are often perceived as more serious and committed, enhancing their attractiveness to sellers looking to finalise deals promptly.

Implications for Buyers

For prospective buyers, the increased presence of cash buyers in the market presents both challenges and opportunities. Those who can purchase with cash are in a stronger position to negotiate favourable terms and secure properties in high-demand areas. However, buyers who rely on mortgages may find it more difficult to compete, particularly in regions with a high proportion of cash transactions.

Looking Forward

As we move further into 2024, it remains to be seen whether the trend towards cash purchases will continue to grow. Economic factors such as interest rates, inflation and overall market stability will play significant roles in shaping the property market. For now, cash buyers hold a distinct advantage, leveraging their position to navigate the current economic landscape effectively.

Are you considering selling your property or looking to buy in the current market? At Belvoir, we have a deep understanding of the dynamics of the property market and can help you navigate these changes. Whether you’re a cash buyer or require mortgage assistance, our experienced team is here to guide you through every step of the process. Contact us today to discuss your property needs and discover how we can assist you in making the most of the current market trends.