With the housing market characterised by soaring property prices and climbing mortgage rates, the ability to purchase a home independently is increasingly challenging. This has led to a noticeable rise in homebuyers seeking financial help from friends and family to secure their place on the property ladder. Whether it’s first-time buyers or those hoping to upgrade their home, many are finding it necessary to explore alternative funding sources to make their dreams of homeownership a reality.

In this article, with the help of information from Dataloft by PriceHubble we will examine the current trends in the housing market, the factors behind the increased reliance on financial assistance from family and friends and the importance of personal savings in the purchasing process. We will also offer some insight into how potential homebuyers can navigate this evolving financial landscape.

Rising Mortgage Rates and Property Prices

The housing market is notoriously competitive, but recent economic conditions have added additional barriers for aspiring homeowners. High mortgage rates and rising property prices are the two primary obstacles that buyers face today. As inflation continues to impact the economy, until very recently, mortgage rates have followed suit, making borrowing more expensive and limiting the purchasing power of many potential buyers. This, coupled with the rising cost of homes, means that many people are finding themselves priced out of the market.

These factors have had a particularly profound effect on first-time buyers, who often have the hardest time saving for a deposit while paying rent and managing other living costs. Even those looking to upgrade or move to a larger home may find that their existing equity doesn’t stretch as far as it once did, forcing them to seek out alternative ways to finance their purchase.

Increasing Reliance on Financial Help from Friends and Family

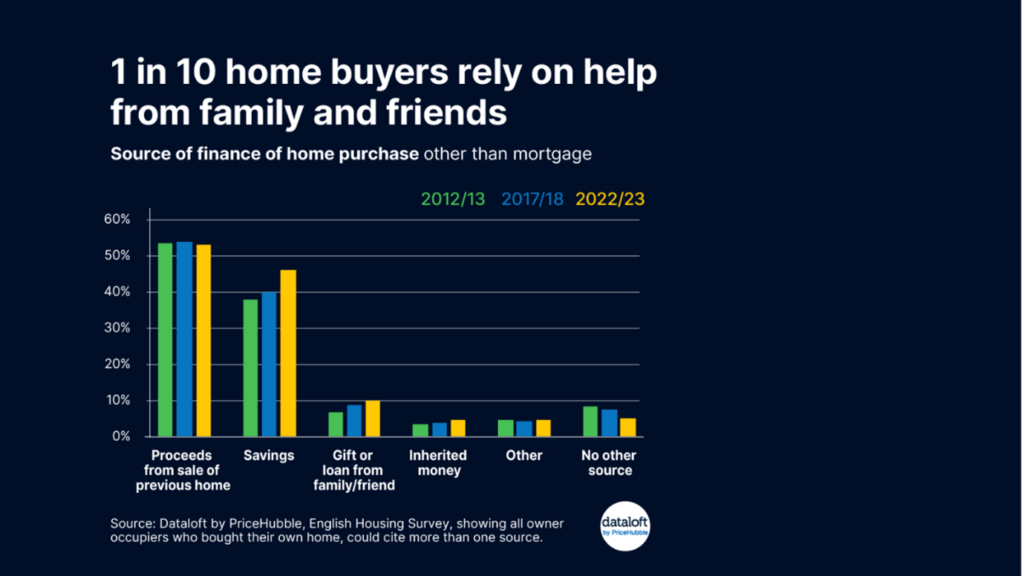

The financial strain caused by these market conditions has led to a growing trend: more homebuyers are turning to friends and family for financial assistance. According to the latest Survey of English Housing, in 2022/23, one in ten homeowners relied on financial help from friends or family to buy their home. This represents a marked increase from a decade ago when just one in fifteen buyers needed such assistance.

This growing reliance on familial support highlights a broader issue in the housing market—buying a home has become more difficult to achieve independently. Many buyers, particularly younger individuals and first-time purchasers, are finding that without the help of a “bank of mum and dad”, buying a home would be out of reach. This assistance often comes in the form of gifted deposits or interest-free loans, which can help cover the significant upfront costs that come with buying a property.

The Role of Personal Savings in Home Purchases

In addition to financial help from friends and family, personal savings continue to play a critical role in the homebuying process. The use of personal savings has increased significantly over the past decade. Today, nearly half of all homebuyers rely on their savings to fund their purchase, compared to 39% ten years ago. With the cost of buying a home continually rising, buyers are increasingly prioritising saving to ensure they have enough funds to cover the deposit and other associated costs.

However, saving for a deposit is becoming increasingly challenging for many, particularly as the cost of living rises. The Bank of England’s increased interest rates mean that saving in traditional accounts yields more in return, but with inflation high, the real value of savings may not grow as fast as needed to keep up with rising house prices. For many buyers, personal savings alone are not enough, necessitating the additional support from family and friends or other financing options.

The Impact on First-Time Buyers

First-time buyers are perhaps the most affected by the current state of the housing market. With no equity from a previous property sale to fall back on, these buyers are reliant on savings, loans and family support to take their first step onto the property ladder. The government’s Help to Buy scheme, which assisted first-time buyers with equity loans, has now ended, making it even more difficult for this group to find affordable ways to enter the housing market.

The increase in house prices has far outstripped wage growth, meaning that many first-time buyers are saving for longer periods before they can afford a deposit. Even with the help of family or friends, they are often limited in their choices, settling for smaller properties or those further from desirable locations. This shift is changing the makeup of the property market, with many younger buyers delaying their homeownership plans or remaining in the rental sector for longer periods.

Alternatives to Traditional Mortgage Routes

While financial assistance from friends and family has become a crucial element for many buyers, there are also other alternative financing options available. Shared ownership schemes, for instance, allow buyers to purchase a share of a property and pay rent on the remaining portion, making it more affordable. Some lenders are now offering products specifically designed for those receiving family support, including guarantor mortgages, where a family member can agree to cover mortgage payments if the buyer is unable to do so.

The rise of innovative financial products demonstrates that the housing market is adapting to the evolving needs of buyers. However, these options are not without risks, and buyers should carefully consider all their financial commitments before making a decision.

Navigating the Future of Homeownership

The rise in homebuyers seeking financial help from friends and family is a clear reflection of the current state of the UK housing market. With rising mortgage rates and house prices, fewer buyers are able to rely solely on their savings or traditional mortgage routes to buy a home. As a result, financial support from loved ones has become a lifeline for many, helping them to achieve their goal of homeownership in a challenging economic climate.

If you are considering buying a home and need guidance on the best financing options available, contact Belvoir Estate Agents today. Our experienced team is ready to help you navigate the complexities of the market, from understanding your mortgage options to finding the perfect property to suit your needs.