Welcome to our first market report of 2024.

Lettings has got off to a good start with competitive interest on both the houses that have come onto the market since we re-opened on 2nd January. While it does not compare to the scale of interest we would have seen two years ago, it does still suggest that demand continues to outstrip supply. That said, pricing remains key and I would always recommend prioritizing quality of Tenant over price.

It is a little early in the year to predict the residential sales market but with interest rate cuts potentially on the horizon we are hopeful that the Spring market will see first time buyers and cash purchasers accompanied by a more general mix of buyers and vendors, with more movement across the market in general. All of our sales agreed in December were to first time buyers and the prices achieved were within 1% of the asking price.

A summary of the information detailed in the report below is available on our website (updated monthly) – see “Local Market Focus”, under the “About Us” tab, or click on the link below:

Colchester Sales Market Overview

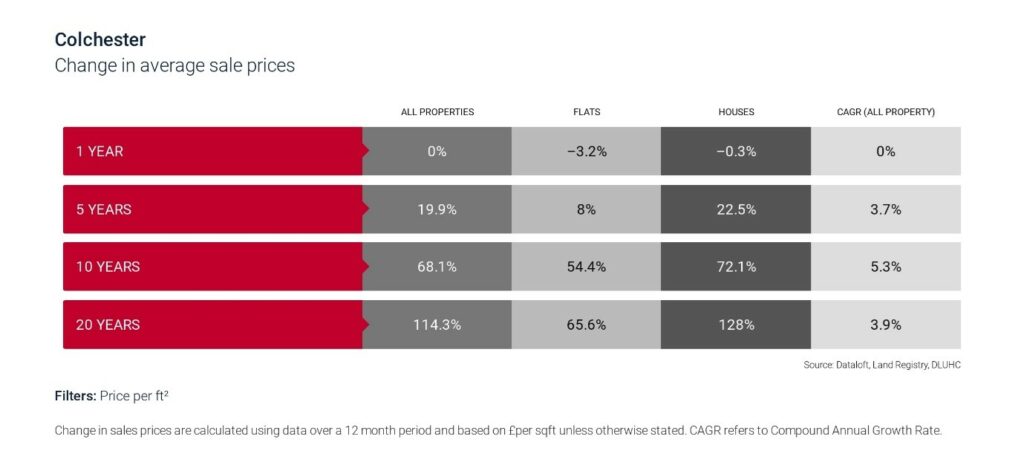

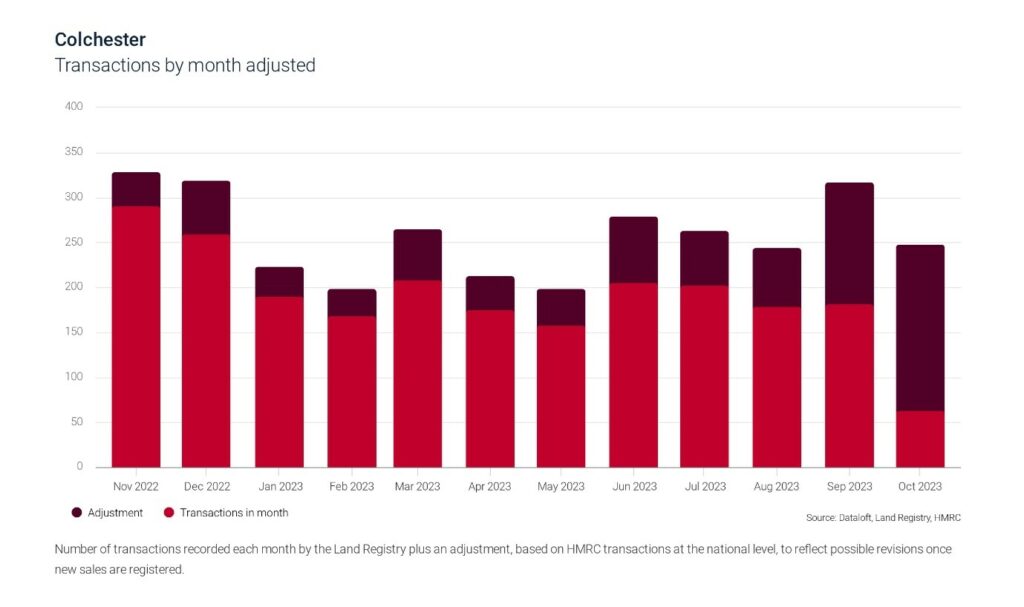

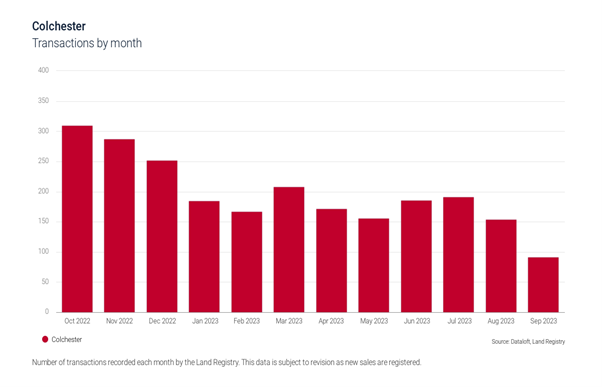

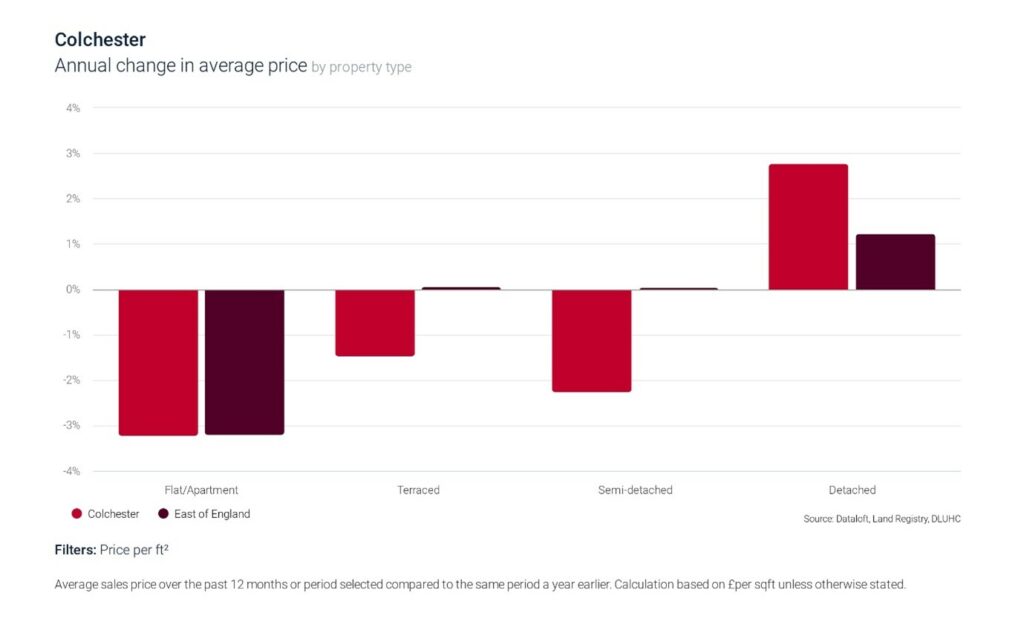

Whilst the overall trend continues downwards in terms of volume of transactions (especially sales of new build properties), and prices achieved (with the exception of detached houses), the sales market over the last five years remains 20% up in terms of property values but flatlining in terms of price rises month to month.

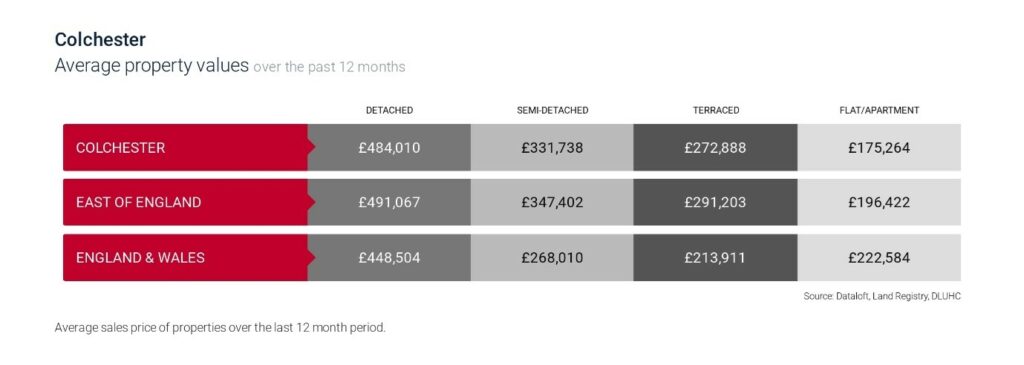

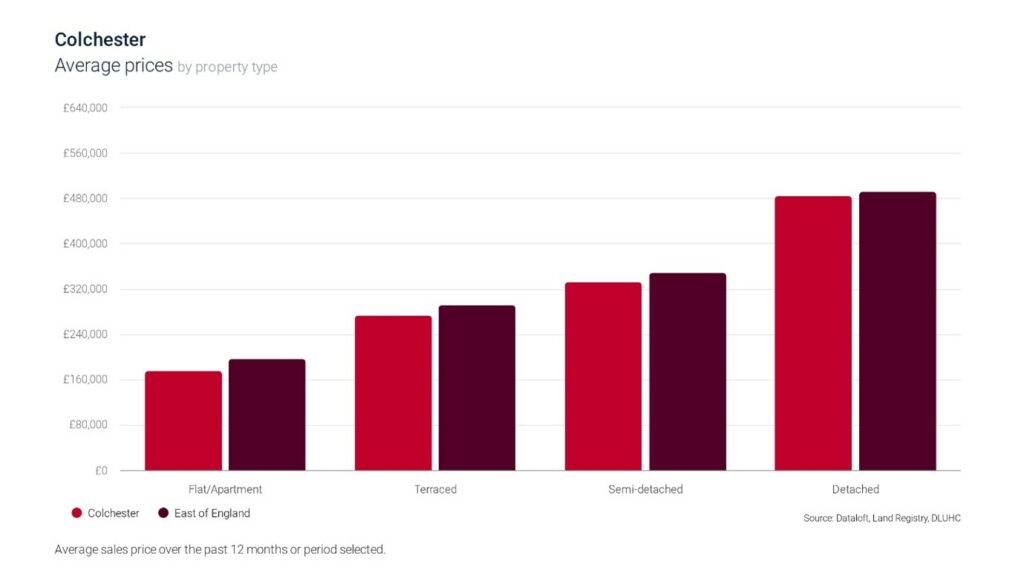

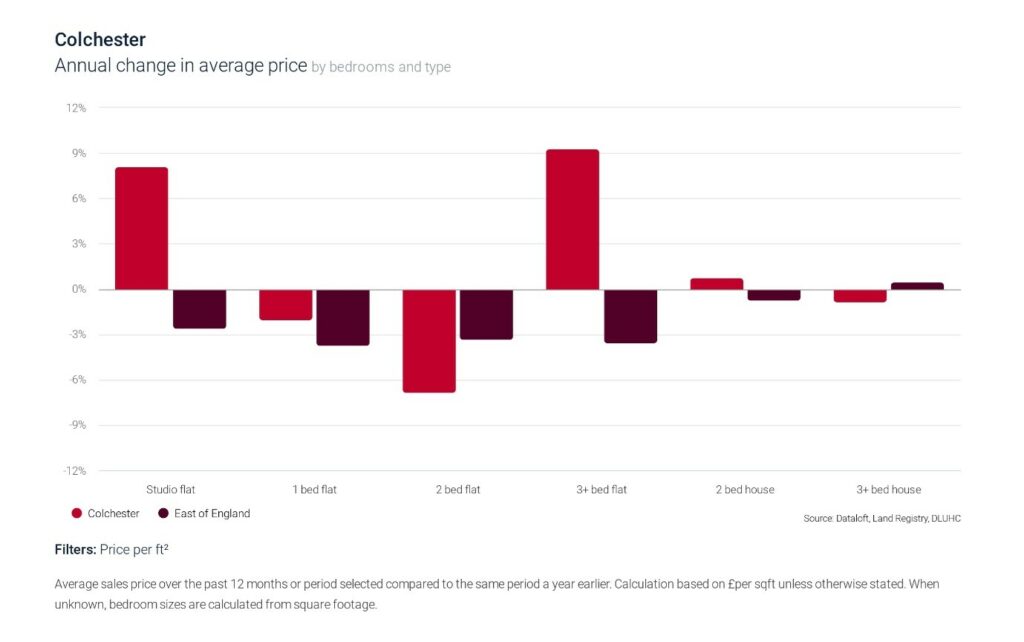

Although the gap is narrowing, you will see from Colchester “Average Sale Price” graph below that Colchester still represents good value when set against the East of England as a whole (especially when you consider the city’s proximity to London), which means that for investors, rental yields in Colchester are holding up. Studio, three bedroom flats and two bedroom houses are seeing price rises in Colchester, whereas across the East of England prices have fallen.

My December comments, in terms of property trading, still apply i.e. those looking to move to a larger property or downswizing, any reduction in value in your property should also be reflected in the price of the property you are looking to buy.

- Over the last 12 months the average sales price in Colchester was £314,029 (down from £315, 402 in December 2023).

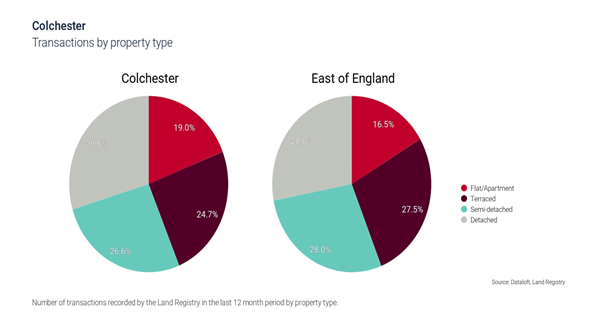

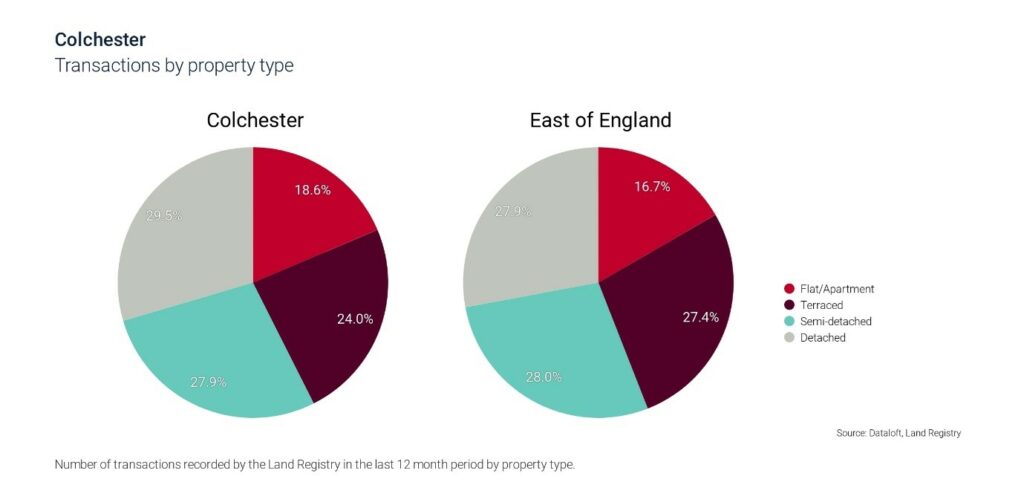

- 19% of sales in the past 12 months were flats, achieving an average sales price of £175,264 (down from £176,564 in December 2023). Houses achieved an average price of £358,512 (down from £360,836).

- High Street, CO5 continues to be the location with the most sales transactions over the last 12 months.

- Over the last three months, of the £154 million in property sales, 16% came from flats; 0% came from new build sales and the balance came from houses.

- The number of sales transactions is 37% lower than this time last year (as opposed to 32% lower in December 2023).

- There were a total of 2,275 sales over the last 12 months (down from 2,359 in December 2023).

- There is no average change in sale price from this time last year (compared to 1% increase in December 2023).

Rightmove Best Buys (as of 25.1.24)

26 Priory Street, CO1 Offers in the Region of £242,500, for the Freehold interest – a three bedroom, two reception, upstairs shower room, good size rear garden, within a short distance of Colchester Town station and the city centre and a great template for cosmetic improvement. Offered chain free. On the market with Pantera Property and the price was reduced 4.12.23. Rental value in the region of £1200 per calendar month.

https://www.rightmove.co.uk/properties/131841005#/?channel=RES_BUY

Greenstead gets a bad rap in the Colchester market, but I think it represents extremely good value. Some parts are better than others and this property on Gardenia Walk, is in a prime spot on the edge of Greenstead. This mid-terrace house would benefit from cosmetic improvement but overlooks a green, has parking, rear garden, two receptions and three bedrooms. On the market with William H Brown for Offers in Excess of £240,000 for the Freehold interest.

https://www.rightmove.co.uk/properties/143178578#/?channel=RES_BUY

I make no apologies for being biased about our final ”Best Buy.” Fresh onto the market, through us, this week, this 2/3 bedroom, 2/3 reception, detached bungalow, with garage, in Clacton On Sea is being sold by the owner who originally bought it off plan in 1957. Lovingly looked after ever since then, the detached bungalow has ample parking, a lovely rear garden and a wonderful template for a new owner to give the home a new lease of life. Douglas Road is on the market at £270,000 for the Freehold interest.

https://www.rightmove.co.uk/properties/143920172#/?channel=RES_BUY

Colchester Rental Market Overview

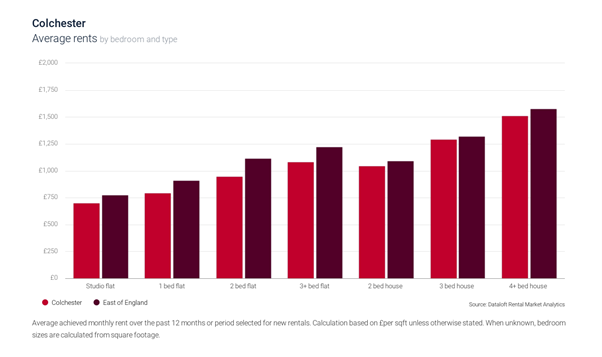

We are seeing a slowing down in terms of turnaround times and volume of applications in the rental market. It is taking longer to secure Tenants, although demand continues to outstrip supply and rents continue to rise. Average monthly rent is now £1,037 (up from £1,018 in December 2023), which represents an 9% increase over the last 12 months (up from 8% in December 2023).

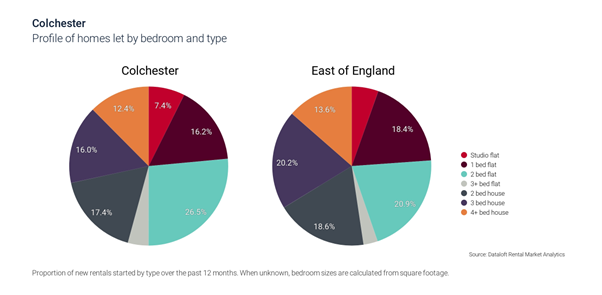

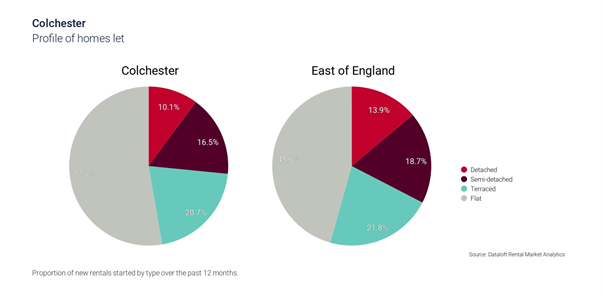

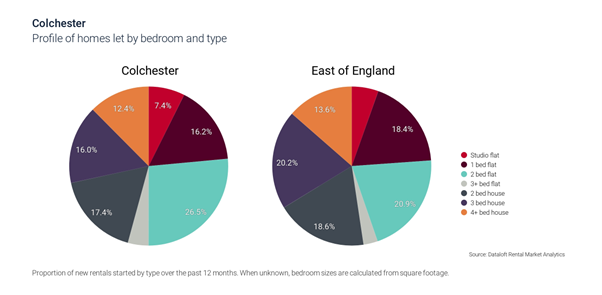

- 51% of homes let in the past 12 months were flats (down from 53% in December 2023), achieving an average rental value of £882 (up from £868 last month), per calendar month. Houses achieved an average rent of £1,225 per month (up from £1,207 in December 2023).

- Rents have increased over 12 months by 8% (up from 7% in November 2023 and 9% over the last 12 months).

- Average age of a Tenant is 34 years (no change from the last two months of 2023), and 23% of renters are aged between 25 and 29 (up from 22% in December 023).

DEPOSIT DISPUTES

Did you know : Disputes about tenancy deposits are raised almost equally by both sides: 48% of disputes are raised by landlords or their agents, and 51% by tenants.

With the DPS, 19.1% of disputes are found in favour of the landlord, and 41.5% in favour of the tenant. A total of 39.4% of cases lead to a split award.

In all cases though it is crucial to have a good quality inventory and a check-in report, as well as a check-out report, done by a professional INDEPENDENT inventory clerk, and the agent who is dealing with the deposit to have very good communication skills and to be focused on the details.

Deposit disputes take time to process and the statistics show that the outcome generally favours the Tenant, so we endeavour to negotiate a fair deal for our Landlords, wherever possible, to avoid having to lodge a dispute. There will, however, be cases where Tenants refuse to negotiate and we will absolutely lodge a dispute where necessary.

And here are our deposit success statistics:

% of received amount by Landlords of the claimed amount – 91.29%

% of move outs which didn’t go to dispute (i.e. an agreement was reached between the Landlord and Tenant about any deductions) – 80.95%

% of our success rate in disputed deposit cases – 87.58%