Welcome to our December market update. The residential lettings market continues to see demand exceed supply, although properties appear to be taking longer to let. Activity in the sales market continues to be driven first time buyers and cash purchasers.

A summary of this information is available on our website (updated monthly) – see “Local Market Focus”, under the “About Us” tab, or click on the link below:

Colchester Sales Market Overview

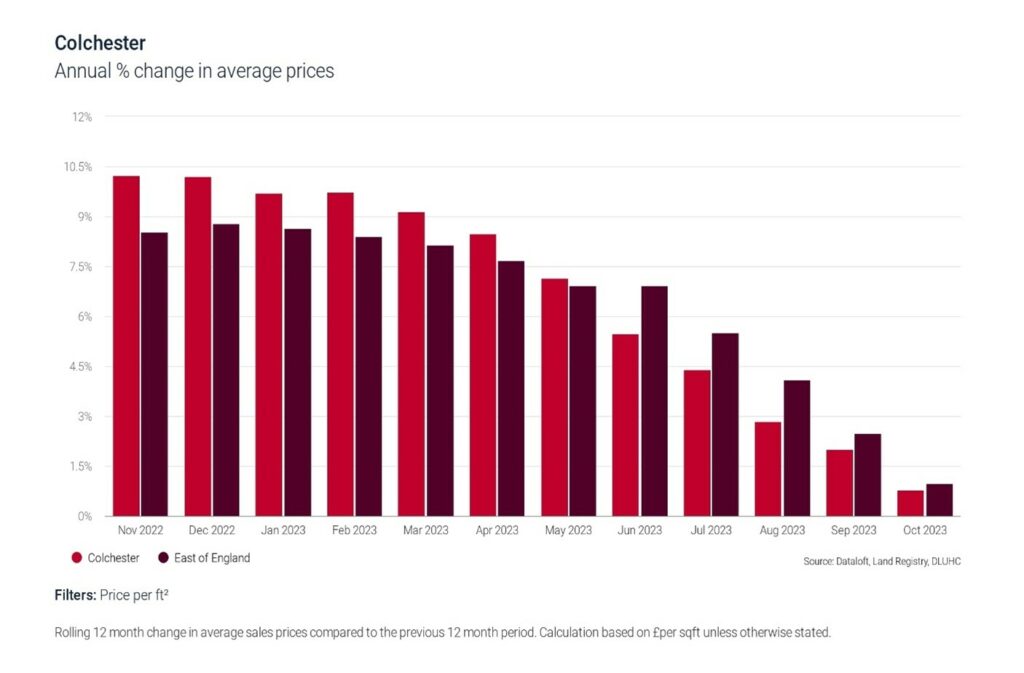

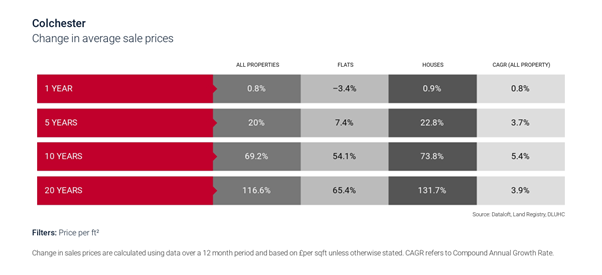

Whilst the overall trend continues downwards in terms of volume of transactions and prices achieved, the sales market over the last five years is still 20% up in terms of property values and still slightly ahead on this time last year. For those looking to move to a larger property, any reduction in value in your property will also be reflected the property you are looking to buy. Property is still selling as long as it is priced competitively.

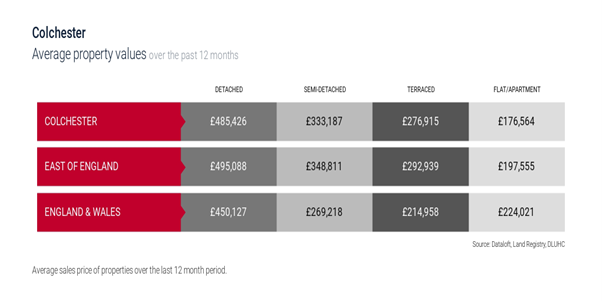

- Over the last 12 months the average sales price in Colchester was £315, 402 (down from £315, 691 in November 2023). The total value of sales was £727,063,721 (down from £777,721,689 in November 2023).

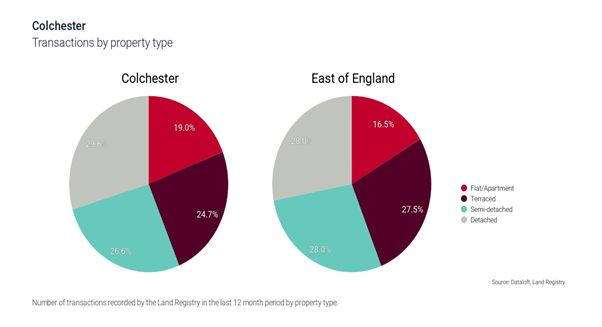

- 19% of sales in the past 12 months were flats, achieving an average sales price of £176,564 (down from £178,698 in November 2023). Houses achieved an average price of £360,836 (down from £362, 210 in November 2023).

- The highest value recorded by the Land Registry over the past 12 months was £975,000 for a flat (no change from November 2023), and £2,585,000 for a house (up from £1,900,000 in November 2023).

- High Street, CO5 continued as the location with the most sales transactions over the last 12 months.

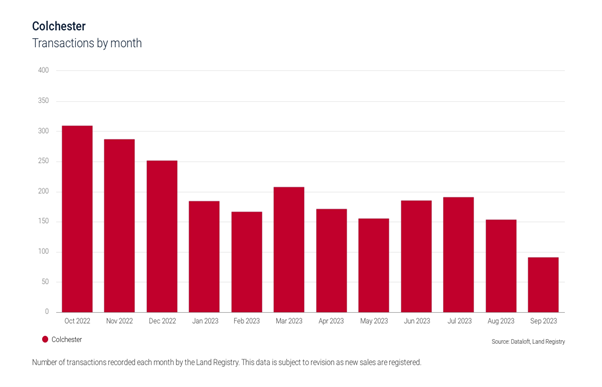

- The number of sales transactions is 32% lower than this time last year.

- There were a total of 2,359 sales over the last 12 months (down from 2,437 in November 2023).

- The average sale price is 1% higher than this time last year (compared to 2% in November 2023).

Rightmove Best Buys (as of 9.12.23)

Kettle Street, CO1 Offers in the Region of £250,000 – a two bedroom, two bathroom, with south west facing garden and parking, within a short distance of Colchester North station. The property has been on the market with Haart since 21.7.23, so there may be a deal to be done. This one is all about location and appears to be in good decorative order. We would anticipate, based on current market conditions, achieving a rent of c. £1100 per calendar month, which represents a yield of c. 5.5%.

https://www.rightmove.co.uk/properties/137709047#/?channel=RES_BUY

Avon Way, CO4 £250,000 – a 3 bed end-terrace freehold house with private rear garden and garage. Came on the market 6.12.23 with Fenn Wright. The house needs some updating but this is a lot of space for your money. As a rental investment, based upon the current market, we would anticipate a rent of £1250 per calendar month i.e. a c. 6% yield. https://www.rightmove.co.uk/properties/142746800#/?channel=RES_BUY

Colchester Rental Market Overview

We are seeing a slowing down in terms of turnaround times in the rental market. It is taking longer to secure Tenants and we are seeing Tenants putting forward offers below the asking price for the first time in a long while. This may well be a sign that the sharp rise in rents over the past year or so are levelling out.

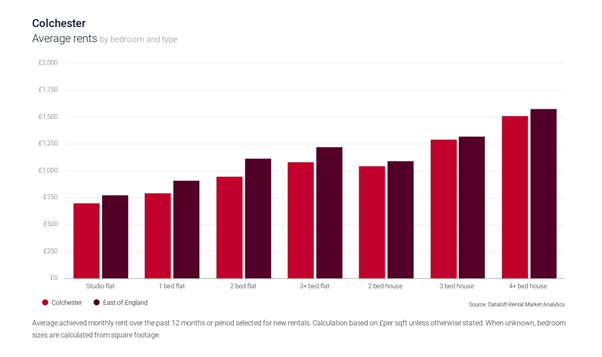

- Average monthly rent is now £1,018 (up from £1,011 in November 2023), which represents an 8% increase over the last 12 months.

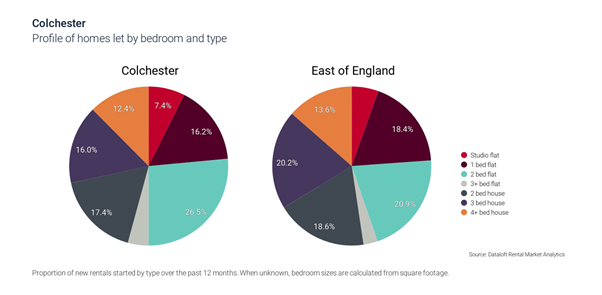

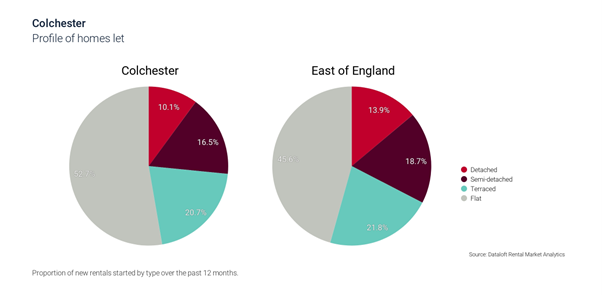

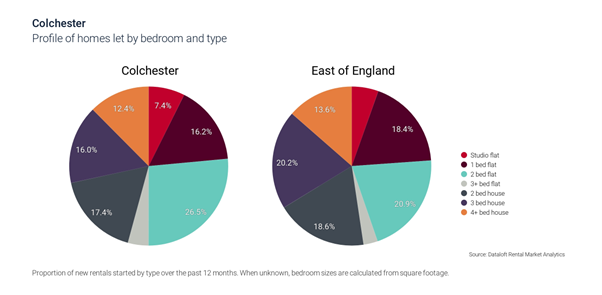

- 53% of homes let in the past 12 months were flats (down from 53% in November 2023), achieving an average rental value of £868 (up from £863 in November 2023), per month. Houses achieved an average rent of £1,207 per month (up from £1,197in November 2023).

- Rents have increased over 12 months by 8% (up from 7% in November 2023).

- Average age of Tenant 34 years (no change from November 2023), and 22% of renters are aged between 25 and 29 (no change from November 2023).

DEPOSIT DISPUTES

Did you know : Disputes about tenancy deposits are raised almost equally by both sides: 48% of disputes are raised by landlords or their agents, and 51% by tenants.

With the DPS, 19.1% of disputes are found in favour of the landlord, and 41.5% in favour of the tenant. A total of 39.4% of cases lead to a split award.

In all cases though it is crucial to have a good quality inventory and a check-in report, as well as a check-out report, done by a professional INDEPENDENT inventory clerk, and the agent who is dealing with the deposit to have very good communication skills and to be focused on the details.

Deposit disputes take time to process and the statistics show that the outcome generally favours the Tenant, so we endeavour to negotiate a fair deal for our Landlords, wherever possible, to avoid having to lodge a dispute. There will, however, be cases where Tenants refuse to negotiate and we will absolutely lodge a dispute where necessary.

And here are our deposit success statistics:

% of received amount by Landlords of the claimed amount – 91.29%

% of move outs which didn’t go to dispute (i.e. an agreement was reached between the Landlord and Tenant about any deductions) – 80.95%

% of our success rate in disputed deposit cases – 87.58%