There is good news for Dundee buy to let landlords as ‘top of the range’ well-presented properties are getting really decent rents compared to a year ago however, this rise in rents is thwarting many potential first time buyers from saving for both a deposit and money for a rainy day. On top of this, there is also a shortage of Dundee homes coming on the market thus adding fuel to the slowdown and affecting not just Dundee first time buyers but also those going up the housing ladder.

Whilst it is true that the Government’s initiatives, targeted at improving the supply of homes built and helping first time buyers obtaining necessary funding, are starting to work (albeit slowly), I also believe that to boost more existing home-owners and their properties onto the market, we as a Country, need to see a better focus placed on those looking to downsize (i.e. the mature generation).

If we took away some hurdles to home owners downsizing, such as removing stamp duty for those downsizers (as was done for first time buyers last year), together with encouraging even more first-time buyers with 100% mortgages to buy the smaller properties, this would in turn release more mid-range properties onto the market, which subsequently would encourage more mature homeowners to downsize from their bigger properties to buy those mid-range properties – thus completing the circle.

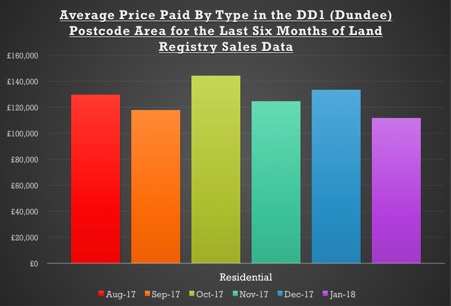

Looking at the most recent set of data from the Land Registry for Dundee (the DD1 postcode in particular), the figures show the indifferent nature of the current Dundee property market.

Only 137 Dundee (DD1) Homes changed hands in the last 6 months

Dundee property values and transactions continue to be sluggish, and the monthly peaks and troughs of house prices and properties changing hands doesn’t mask the deficiency of suitable realistically priced property coming onto the Dundee property market, meaning the housing market is slowly becoming inaccessible to some would-be home owners.

Looking at what property is selling for in DD1 (note the data from the Land Registry is always 4/5 months behind) makes interesting reading ….

| Aug-17 | Sep-17 | Oct-17 | Nov-17 | Dec-17 | Jan-18 |

| Percentage Change Between Aug 17 and Jan 18 |

Residential | £129,531 | £117,750 | £144,114 | £124,426 | £133,275 | £111,438 |

| -13.97% |

One must remember these are the average prices paid, so it only takes a run of a few expensive or cheaper property types to affect the figures..

Looking at the numbers of properties for sale … I looked at my research for early Summer 2008, and at that time, 1,188 properties were on the market for sale in Dundee.. and when I did my research on this article today, just 568 properties for sale.. a drop of 52%.

The Government needs to seriously consider the supply and demand of the UK property market as a whole to ensure it doesn’t seize up. It needs to do that with bold and forward-thinking plans but, in the meantime, people still need a roof over their head, so as local authorities don’t have the cash to build new houses anymore, it’s the job of Dundee landlords to take up the slack. I must stress though, I have noticed a distinct ‘flight to quality’ by Dundee tenants, who are prepared to pay top dollar for an exceptional home to rent. If you want to know what tenants are looking for and what type of things you as a Dundee landlord need to do to maximise your rental returns – drop me a line.