64.4% More Edinburgh Properties on the Market in Last 20 Months:

In recent months, the British property market in certain parts of the country, has exhibited signs of cooling.

As a result, homeowners selling their homes face increasing competition from more homes on the market.

The increase in mortgage rates has played a pivotal role in this cooling, taking a toll on potential buyers’ incomes, thereby lowering affordability and demand.

The consequence? Some previously buoyant regions, especially in the South, have experienced price corrections.

As the market faces this colder front, local factors like the availability of reputed schools, amenities, and public services remain paramount for those looking to buy.

The Overpricing Trap

In a tougher property market, a common strategy by some agents is to suggest you put your property on the market at an inflated price, only to encourage the homeowner to drop it months later.

Large estate agencies have the resources to allow many listed homes to remain unsold, whereas smaller agencies rely heavily on consistent sales. Hence, the latter often propose more realistic prices to ensure they get the house sold.

I have encountered countless Edinburgh homeowners being advised to list their property at an elevated price despite their reservations. Over time, with sparse viewings and no genuine offers, they drop the asking price. The original overestimation meant a prolonged waiting period and they lost homes that they wanted to buy. People like to think they are level-headed and wise to such tricks.

So why does this happen? Remember, greed can take over when an estate agent says they can get you an extra £30k than another agent. That is why estate agents do it.

Of course, it’s tempting to price your Edinburgh home ambitiously. While testing the waters with a slightly higher price tag is understandable (we do it often at our agency), refusing to adjust the asking price after the first few weeks if there is no substantial interest could be a costly mistake.

An overpriced home can stagnate on the market, leading potential buyers to assume there’s something wrong with it. The longer it sits unsold, the more it becomes stigmatised.

A lack of early interest regarding viewings should be a clear signal; if there are no serious inquiries and/or offers within the first few weeks, it’s imperative to reconsider the asking price. By being responsive and proactive, Edinburgh homeowners can avoid the pitfalls of a stale listing and increase their chances of a successful sale and move.

So why is it so much of an issue now?

64.4% more Edinburgh homes are on the market

today than 20 months ago

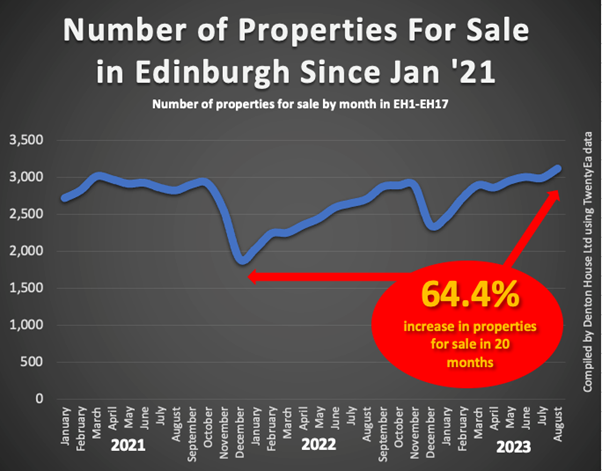

2021 was an exceptional year for people moving home. There were more buyers than sellers, meaning the number of properties on the market in Edinburgh was reduced. Looking at the numbers…

The number of properties on the market on 1st January 2021 in the Edinburgh area (EH1-EH17) was 2,720, but by 31st December 2021, that had reduced to 1,897.

By the 31st December 2022, that had increased to 2,354 homes for sale, a rise of 24.1% in only 12 months.

It has continued to rise and today stands at 3,118 properties for sale, a rise of 64.4% in 20 months.

With the average number of sales per month in the Edinburgh area 20.3% lower per month in 2023 than in 2021, with greater supply (64.4% more properties for sale) and that slightly lower demand (i.e. sales down 20.3%) … getting your asking price right is vital.

Determining the Right Price

Edinburgh buyers and sellers can arm themselves with information about the Edinburgh property market. Many online platforms provide data about sold property prices in specific areas, giving Edinburgh homeowners a benchmark. Additionally, the time properties spend on the market can provide insights into an agent’s efficiency (again the portals like Rightmove and Zoopla show you this).

When selling, obtaining valuations from multiple agents and critically analysing them is vital. It’s crucial to ensure that agents provide evidence to back their valuations, enabling homeowners to make informed decisions.

Rethinking the Selling Strategy

The Edinburgh property market tends to shift collectively, much like boats carried by the same tide. Things are okay if you’re not faced with financial losses and can manage an upgrade. Many assume continuous gains are certain when selling your home, but the real profit materialises only when you part with your final property. You may not even realise this profit directly, but it could be used later for elderly care expenses or as a legacy for your family.

Once a property is listed, attention to its online journey is essential. The initial four weeks provide insights into whether your Edinburgh property is priced correctly, gauged by the number of web views on the portals, actual viewings of your property and offers received.

Yet, deciding to reduce the listing price is more than just about attracting buyers; personal timelines and goals play a significant role. For instance, one might ponder: Is there a deadline by when the property must be sold? Can waiting a few months make a difference? These considerations help in making informed decisions on price adjustments.

However, it’s beneficial to consider independent or boutique agents, like our agency in Edinburgh, in a challenging market. They often tend to offer a more authentic experience and realistic valuations.

Finally, one strategy employed by some savvy Edinburgh home sellers is to list their property at a slightly lower price to spark more interest and drive up offers.

Switching Agents or Going Online?

With a slow property market, one’s patience can wear thin. If you are considering switching agents, sellers should evaluate the current agent’s efforts and communication frequency. Another option is multi-agency agreements. However, this approach has recently declined due to associated higher fees.

With their fixed fees and remote operations, online agencies seem like an attractive option. Yet, their one-size-fits-all model can fail to capture the nuances of individual properties, making them less effective in slower property markets.

Renting as an Alternative

Renting out unsold properties is gaining traction where rent is rising. However, prospective landlords should tread carefully, considering growing mortgage interests, tax restrictions, and tenant-related challenges. Again, if that is a potential option for you, do give our agency a call.

Final Thoughts

The current Edinburgh property market is complex. The recent freeze by the Bank of England base rates is a welcome pause. It won’t turn the Edinburgh property market into a frenzy like the land and buildings transaction tax holiday did in mid-2020, yet it is a welcome respite.

With the right strategies and awareness, Edinburgh home sellers can effectively navigate these waters, ensuring their property finds the right buyer at the right price.

If you are an Edinburgh property market owner, and this article has sparked any questions, do not hesitate to give the office a call.