If you’ve ever considered selling your Northampton home, you may have felt the temptation to list it at a higher price, hoping for a bigger payday. After all, who wouldn’t want to maximise the return on their largest tax-free investment?

However, this approach has a downside that many Northampton homeowners – and even some estate agents- overlook: the risks and costs associated with overpricing/overvaluing your property. Recent data shows that homes priced too high take much longer to sell and are far less likely to complete the sale successfully. Let’s dive into why correct pricing is essential to ensure a smooth and profitable sale for your Northampton property.

Overpricing: A Common Pitfall in Northampton’s Property Market

In recent years, the Northampton property market has seen a surge in home prices, leading to fierce competition among estate agents. During the peak of the market in 2021, many Northampton agents achieved top prices for properties, often receiving multiple offers in a matter of days. It became the norm for a Northampton home to sell quickly and for prices that exceeded expectations.

However, this boom came with unintended consequences. As fewer Northampton homes came onto the market, some agents became desperate to secure listings. To win over potential sellers, many estate agents started overpricing properties (or, sometimes described as, overvaluing), offering inflated appraisals that gave homeowners unrealistic expectations. While this might sound like a winning strategy to get more money for your home, it has caused significant distress and delays for many Northampton homeowners.

The Impact of Overvaluing: Longer Sale Times and Increased Risk

So, why are so many properties in Northampton still on the market after all this time? It often boils down to one thing: overvaluing. When a property is priced too high, it doesn’t attract serious buyers. Instead, it sits on the market for an extended period, leading to frustration for both the homeowner and the estate agent. Ultimately, it gets withdrawn from the market unsold.

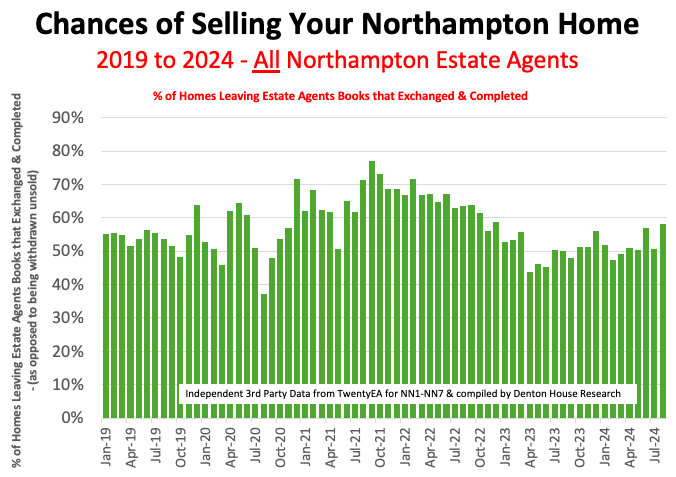

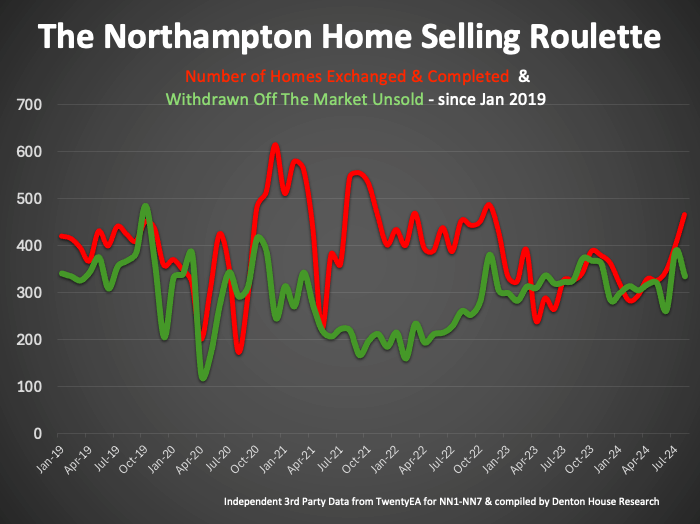

So, let us look at the over-valuing statistics for Northampton since 2019.

Northampton – NN1-NN7:

- In 2019, 50.3% of the 9,829 properties that left Northampton estate agent books, exchanged and completed. The remaining 4,881 (or 49.7%) Northampton homeowners came off the market unsold.

- In 2020, 66.3% of the 8,004 properties that left Northampton estate agent books, exchanged and completed. The remaining 3,611 (or 45.1%) Northampton homeowners came off the market unsold.

- In 2021, 66.3% of the 8,380 properties that left Northampton estate agent books, exchanged and completed. The remaining 2,820 (or 33.7%) Northampton homeowners came off the market unsold.

- In 2022, 63.9% of the 8,101 properties that left Northampton estate agent books, exchanged and completed. The remaining 2,928 (or 36.1%) Northampton homeowners came off the market unsold.

- In 2023, 50.5% of the 7,849 properties that left Northampton estate agent books, exchanged and completed. The remaining 3,886 (or 49.5%) Northampton homeowners came off the market unsold.

- In 2024 (YTD), 52.1% of the 5,294 properties that left Northampton estate agent books, exchanged and completed. The remaining 2,534 (or 47.9%) Northampton homeowners came off the market unsold.

Since 2019, 20,660 Northampton homeowners who placed their property on the market have withdrawn their homes unsold, many because of overvaluing.

The Hard Data on Overvaluing

If the evidence isn’t enough to convince you, let’s look at more data.

Now, you could reduce your asking price after three or four months to make your home more realistic. That is certainly an option, yet because homes that sit on the market for too long often develop a negative reputation, potential buyers wonder why the property hasn’t sold and may assume something is wrong with it.

As a result, even when the price is eventually lowered, as reported a few years ago, the property is likely to sell for less than it would have if it had been priced correctly from the beginning.

Also, let me remind you of the recent independent research from TwentyEa and Denton House Research, that a UK home that takes over 100 days to sell (i.e. more than 100 days between coming on the market and agreeing a sale) has only just over a 1 in 2 chance (56%) of successfully exchanging and completing the sale. The remaining 44% of sales fall through.

In contrast, if a property has its sale agreed in under 25 days, the chances of exchanging and completing rise to 19 out of 20 (94%). That’s a significant difference! If this isn’t a clear sign that overvaluing is causing harm to homeowners, which creates a lot of wasted time, stress, and disappointment for homeowners, I don’t know what it is.

Why Do Some Northampton Estate Agents Overvalue?

Many homeowners wonder why estate agents overvalue a property if it ultimately harms the chances of a successful sale and the agent getting paid. The answer lies in the competitive nature of the industry. Some agents, especially those working for larger estate agency firms, are under pressure to secure as many listings as possible. This pressure can lead to overvaluing, as agents sometimes even receive commissions for getting a property onto the market, regardless of whether it sells.

These Northampton agents appeal to a homeowner’s desire to get the highest possible price by offering an inflated valuation. However, once the property is listed, they often encourage gradual price reductions over time, hoping to eventually make the sale. Unfortunately, this delay can cause the homeowner to miss out on their dream home or sell for less than they would have if they had listed it at a fair price from the start.

The Importance of Correct Pricing Your Northampton Home

So, what can you do to avoid falling into the overvaluing trap? The key is to ensure your Northampton home is priced correctly from the outset. Here are a few tips to help you achieve that:

- Get Multiple Valuations: Don’t rely on one Northampton agent’s opinion. Ask several Northampton estate agents to value your home and compare their suggestions. Be wary of any agent who offers a significantly higher valuation than the others without solid evidence to back it up. Trust is key in this process, so make sure you’re working with agents you can rely on.

- Research Comparable Sales: Look at similar properties in your area that have recently sold. Sites like Rightmove, Zoopla, and OnTheMarket allow you to search for homes under offer or sold subject to contract, giving you a better sense of realistic pricing.

- Understand the Market Conditions: The property market is constantly changing. While prices may have skyrocketed in 2021, the market has since cooled off. Make sure your valuation reflects current conditions, not the highs of the past.

- Work with a Trustworthy Agent: Choose an estate agent with a reputation for honest and accurate valuations. A good agent will prioritise finding the best buyer for your home at the right price rather than inflating the value to win your business.

Final Thoughts

Overvaluing might seem tempting, but the risks far outweigh the potential rewards. Not only does it result in longer sale times, but it also decreases the likelihood of a successful completion. By pricing your Northampton home accurately from the start, you can increase your chances of getting a decent price and a smooth and profitable sale.

Remember, the goal isn’t just to sell your Northampton home – it’s to sell it for the best price, within the best time frame, to a serious and motivated buyer. By working with an experienced and honest estate agent, you can avoid the pitfalls of overvaluing and achieve the successful sale you deserve.

If you have any questions or would like more advice on selling your Northampton home, feel free to contact us. We’re here to help!