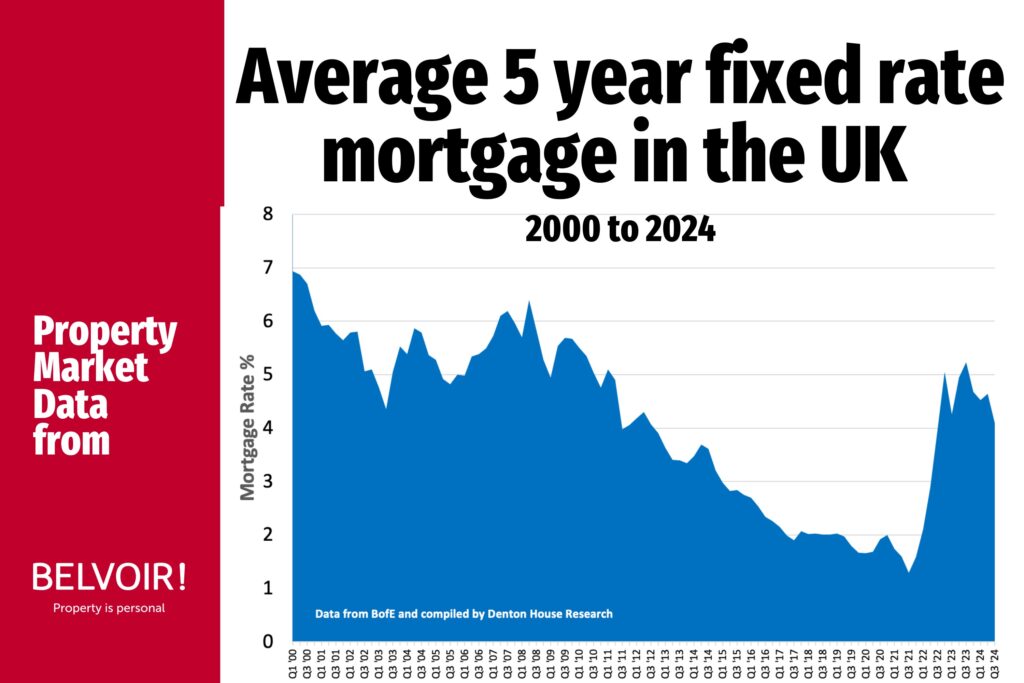

The graphic above illustrates the average five-year fixed mortgage rate in the UK from 2000 to 2024. While there has been a noticeable rise in mortgage rates over the past couple of years, it’s worth highlighting that today’s rates are still significantly below the peaks we witnessed in the early 2000s and during the financial crisis. This perspective is essential for homeowners and buyers in Northampton to consider.

For local property buyers and sellers, these shifts in mortgage rates have a direct impact. Higher rates can tighten affordability for buyers, while sellers may see some softening in demand. However, compared to historic highs, today’s rates remain competitive, and well-prepared buyers can still secure favourable deals with the right guidance.

If you’re thinking about how these mortgage rate trends might affect your next move in Northampton’s property market, we’d be delighted to have a conversation. Whether you’re buying, selling, or just keeping an eye on the market, let’s discuss how to make the most of the current conditions.

Feel free to give us a call on 01604 626 626 – we are here to help navigate you through the changing landscape of the Northampton property market.