We believe most people are becoming more conscious of where their money is being spent amongst the ongoing ‘Cost of Living Crisis’ and this applies to both Tenants and Landlords. Michelle Gordon, Belvoir Peterborough’s Lettings Manager has reviewed what this means for the local, regional and national rental market.

Let’s glance at the Peterborough and surrounding markets:

In the past year, Peterborough has seen a 9% increase in average rents with £823 PCM being the average across all property types let. The chart below outlines these changes for the past year and for the past 5 years:

The change in average rents in Peterborough compared to the rest of the East of England can be seen below. This data is based on September 2021 – August 2022 compared to the same period 12 months earlier:

An example we’ve seen of rising rents here at Belvoir Peterborough below to two properties we manage: 22 & 24 Marius Crescent in Peterborough. 22 Marius Crescent was originally let agreed at £975pcm but during the tenancy went to £1025pcm. After the tenant had given notice we then re-let the property for £1095pcm in April this year meaning a 11.6% increase from the original rent.

24 Marius Crescent, just next door shared a similar story; rent increase for the tenants in occupation went from £975pcm – £1050pcm. Upon notice, we re-marketed the property and achieved £1150pcm in June calculating at a 16.5% difference from the original rent.

These properties are identical in property type and have shown a 5% increase to their rents between April – June 2022 in two months which shows just how rapidly the rental market is changing at the moment.

Lets take a look nationally:

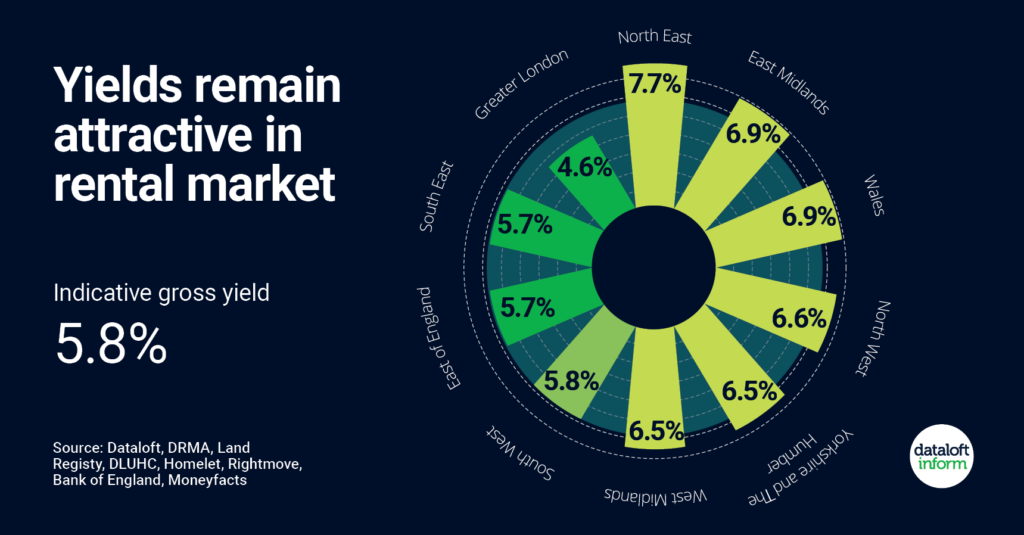

Recently, in the ‘A Fairer Private Rented Sector’ Housing Reforms announced in June this year, saw The Government put forward: “Only allowing increased to rent once per year, ending the use of rent review clauses and improving tenants’ ability to challenge excessive rent increases through the First Tier Tribunal.” However, yields are still strong for Landlords as rents rise in all regions:

The average rent in the UK at the end of April 2022 was £1,091 pcm, up 9.5% on the same time last year. Positive annual and monthly change in rental prices have been recorded in every region. London has seen the highest increases: annual (14.2%) and monthly (1.9%). The cost-of-living crisis could put downward pressure on rental growth. Currently, the imbalance between supply and demand continues to be the force behind rent inflation.

What does this mean for Landlords?

Indicative gross yields remain attractive in the rental market. Based on an analysis of apartments sold and rented over the past 12 months the indicative gross yield is 5.8%. This is up from 5.1% 3 years ago. Indicative gross yields have risen across all regions of England and Wales compared to three years ago. A survey of over 1,000 landlords by Dataloft with Homelet found that the majority (73%) of landlords were planning for their portfolios to stay the same over the next year, 1 in 10 looking to expand. Nearly half see their portfolio as their long-term pension, a further 25% consider property the best place to invest, and 17% hope to increase their monthly income. Rightmove predict rental values will rise by 8% over the course of 2022, rental price growth set to outpace sales growth.

What does this mean for renters?

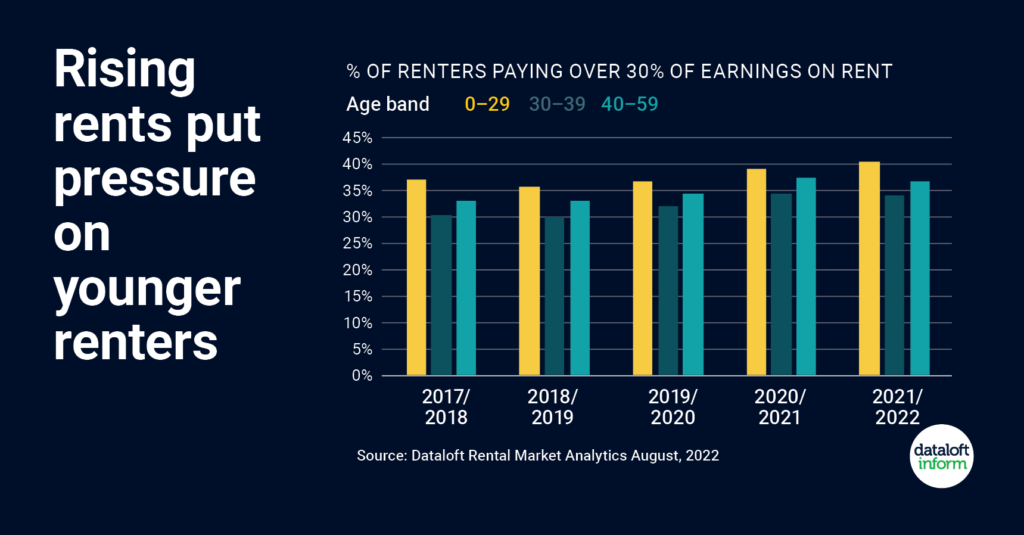

With the rising cost of living dominating the headlines, we have turned our attention the the rental market and the affordability pressures facing renters. Using gross incomes of renters and achieved rents we can see how much tenants are really spending on rent. If we put this into local perspective, the average age of tenants in Peterborough is 34.

As featured in a recent BBC report, 4 in 10 young renters (aged under 30) are now spending at least 30% of their income on rent, the widely accepted affordability threshold. While all living costs are under intense scrutiny at the moment, most renters will be prevented from over-stretching on their rent commitment, by the stringent tenant referencing process. To pass the affordability test for tenant referencing on a new lease, the rent should represent no more than 30% of a renter’s gross income. This affordability analysis is based on data from around 40% of all new rentals.

In summary, it could be argued that Landlords are cashing in whilst exacerbating the cost of living but that isn’t to say they won’t be affected as inflation continues to rise. This is particularly prevalent for those Landlords who have mortgages on their properties and may be vulnerable to the rapid rises in interest rates from the Bank of England. The 12-month outlook is starting to ease slightly for rents but they are expected to overtake that of house prices over the next five years.