- Impact of coronavirus saw 57% fall in demand for rental housing in the two weeks to 30 March; the fall in demand has since bottomed out and rebounded 30%, off a low base, in the two weeks to 14 April

- Despite signs of life, rental demand is still 42% lower than at the start of March

- The increase in demand has been uniform across the market by region and price

- Rental supply increased ahead of the lockdown as landlords switched from the short to the long-let market but the growth in new supply has since slowed

- There has been no mass withdrawal of rental properties listed to let, down just 3% compared to 1 March

- There are 1.2m moves a year in the lettings market and we expect this to fall 25% over 2020, compared to 2019

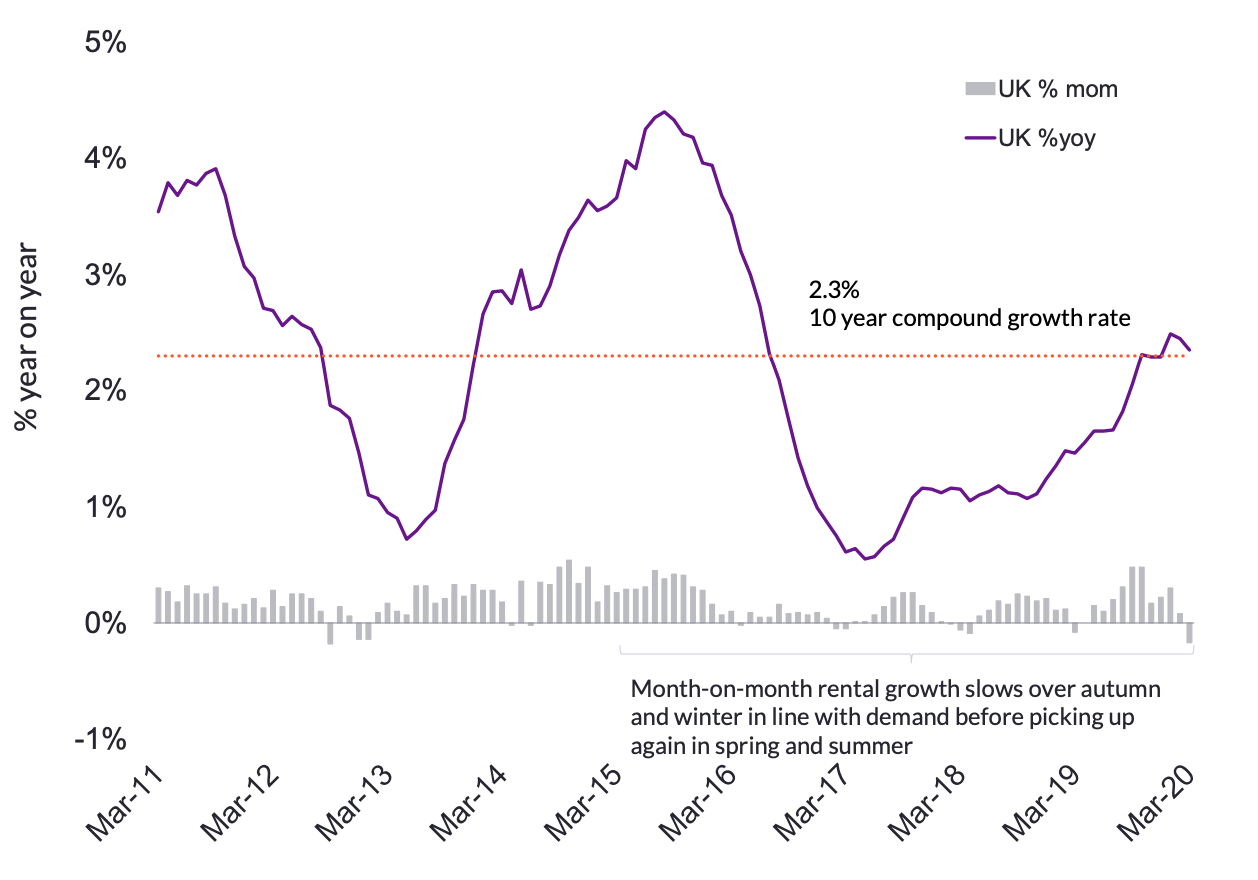

- Annual UK rental growth is at 2.4%, up from 1.5% in March last year; rental growth for the rest of the year is expected to moderate but remain in positive territory

Welcome to the first quarterly Rental Market report of 2020. Our unique analysis accurately tracks changes in demand and prices across the country. This quarter’s report shows a market better able to adjust to shocks than sales. We’ve seen a modest demand rebound in the last fortnight as rental transactions continue during lockdown, albeit at a lower rate.

Rental market resilience

The impact of coronavirus has been less pronounced in the lettings market than in the sales market. Increased uncertainty means households looking for a home will turn to the rental market first to meet any immediate housing need.

Demand for rental properties fell by more than 55% between 7 March and 30 March. In contrast, the sales market was hit by a 70% decline in buyer demand, after the government effectively suspended transactions.

The additional flexibility in the lettings market, which has allowed agents to agree rental contracts with delayed start dates, and agree terms based on online viewings, means that activity has continued throughout the lockdown, albeit at a significantly lower rate.

Once lockdown restrictions ease, activity levels will likely rise and match previous years’ levels in the typically busier seasonal periods in Q3 and Q4. We anticipate that the total number of moves within the rental sector will be approximately 25% lower than in 2019.

The total number of properties listed as available to rent remains broadly unchanged since the start of the lockdown, down 3% since March 1, indicating that there has been no large-scale withdrawal of listings.

Fig. 1: Headline UK Rental Growth (%YOY and %MOM)

Slight shift in London price band demand

The growth in demand has been uniform across the market both by region and price bands.

When examining which properties tenants are engaging with online, the data indicates across the country, excluding London, the £500-£600 pcm bracket is the most popular, consistent with trends seen before COVID-19 emerged.

By contrast, London has recorded a marginal shift in demand, with the largest proportion of interest focused on properties with rents of between £1,200 – £1,300 pcm in April, compared to February, when the greatest interest was in properties priced between £1,400 – £1,500 pcm. This could be partly attributed to a change in the financial circumstances of some tenants, but it’s premature to conclude whether this trend will persist.

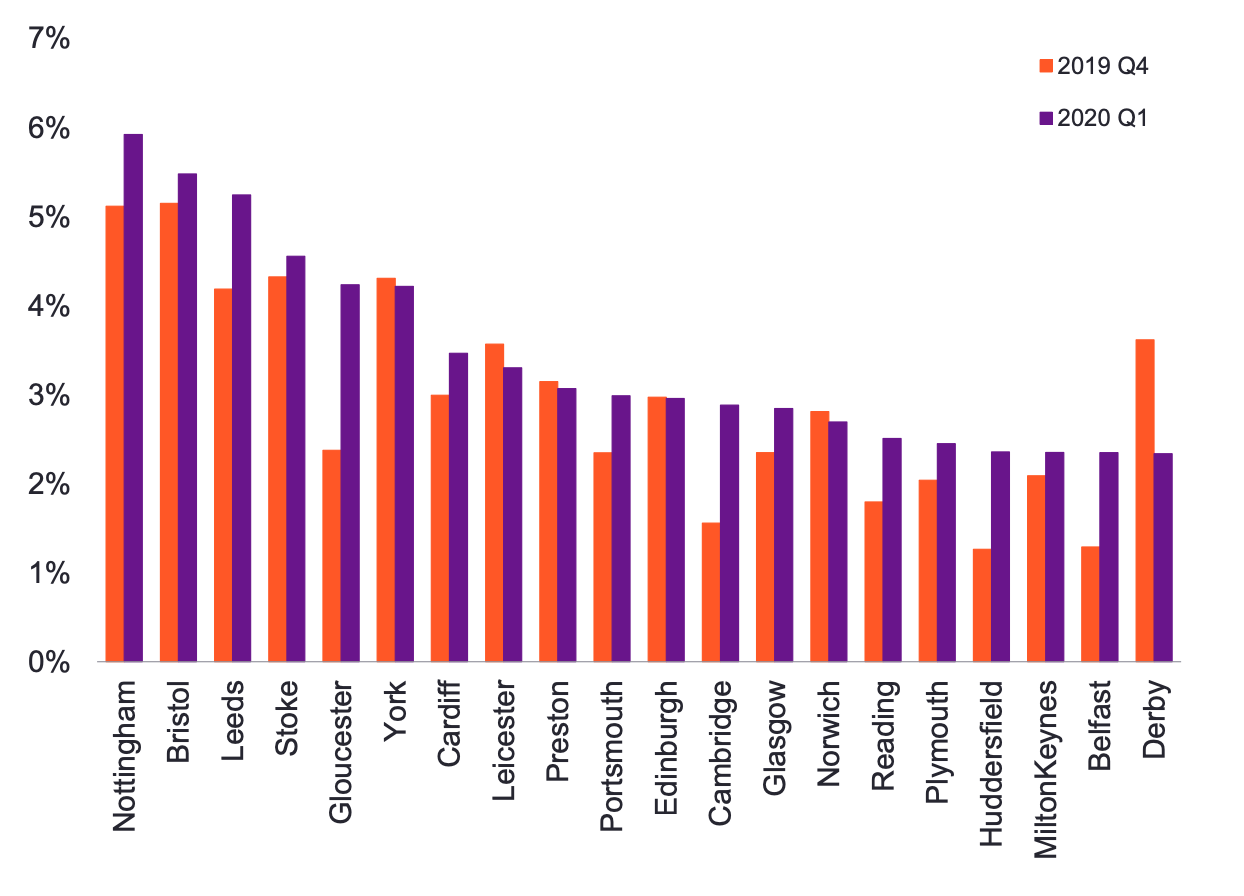

Top 20 cities registering highest annual rental growth

Top 20 cities registering lowest annual rental growth

An underlying strength in rents

The Rental Market Report shows that the annual rate of UK rental growth flattened in March – reflective of seasonal trends rather than ramifications of the coronavirus lockdown. Rents were up 2.4% on the year, compared to 2.5% annual growth in February and the 2.3% recorded in December 2019.

Despite the slight slowdown in growth, rental growth has been on a largely upward trajectory since March 2017 amid increased demand and shrinking supply.

At a city level, the spread of rental growth ranges from -2.1% in Aberdeen to 5.9% in Nottingham. Annual rental growth in London is running at 1.7%, down from 2.3% in the previous quarter, but broadly in line with the same period in 2019 (1.8%).

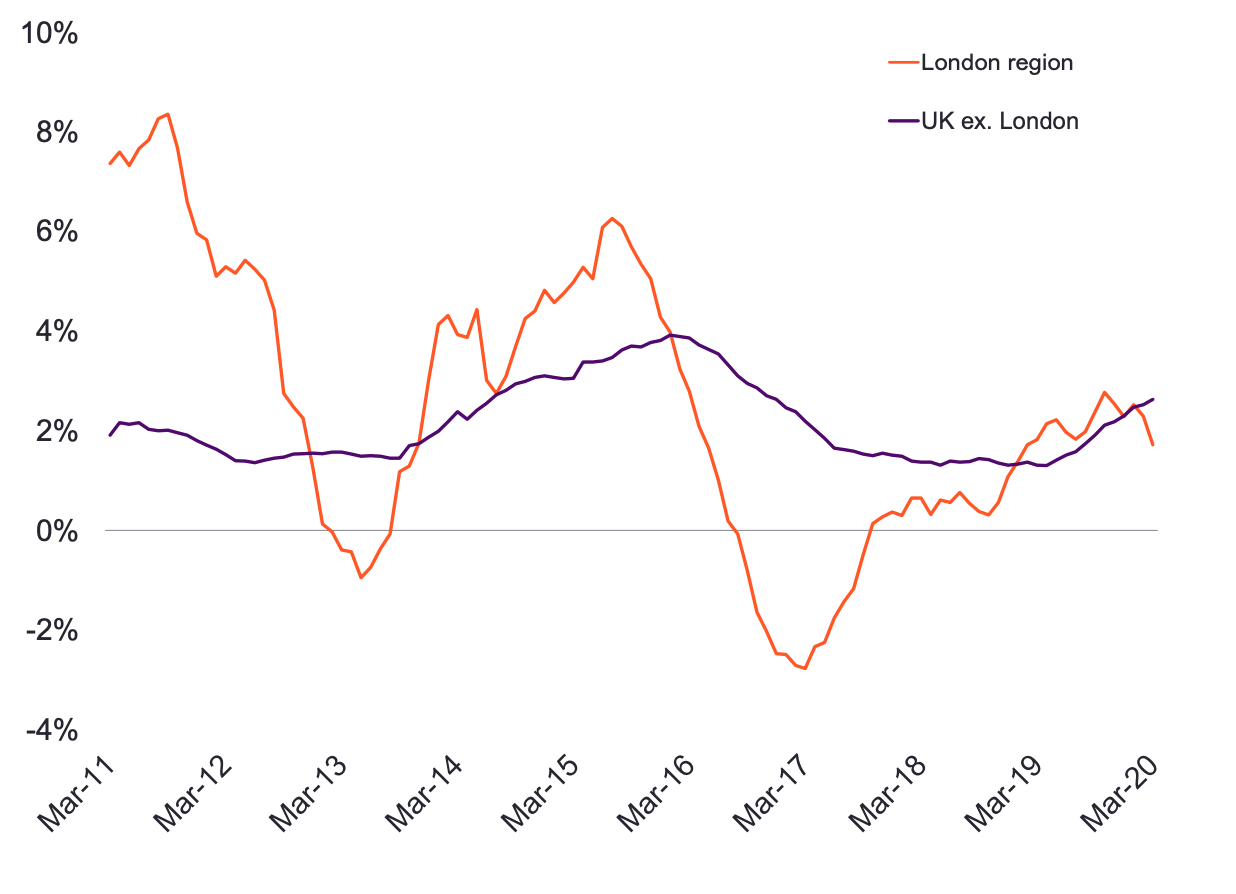

For the first time in 12 months, London’s pace of rental growth has fallen behind the rest of the UK, as stretched rental affordability limits the rate at which rents can grow when compared to the rest of the UK.

Rental growth in London, having risen strongly since March 2017, slowed down slightly during March 2020, with 1.7% annual growth, down from 2.3% in February 2020. This may partially reflect a slight easing in demand given the post-election bounce in the sales market.

While a lack of supply and slower new investment has supported the uplift in rental growth over the last two years, a sustained delivery of new supply from new-build schemes is adding more rental homes to the market and therefore keeping rental growth in check.

Rental growth – London region and UK excluding London