Despite the anticipations and speculations surrounding the UK General Election, its impact on the UK and Portsmouth property market has been negligible.

Market trends, buyer interest, and property values have remained steady, showing no significant fluctuations attributable to the political climate. This stability suggests that factors such as economic fundamentals, interest rates, and housing supply continue to play a more crucial role in shaping the property market’s dynamics than the election results.

Portsmouth homeowners and buyers alike have maintained their focus on these core elements, demonstrating resilience and continuity in their property-related decisions. So, as the commentators predict a Labour ‘Super Majority’, could we see another ‘Boris Bounce‘ in the post-election months like we saw in early 2020?

If we do, what could it be called? The ‘Starmer Surge’?

Yet before we pop the Champagne (or commiserate with the same stuff), it doesn’t matter. Why? Irrespective of who wins the election, there are bigger fish to fry.

Homeowners looking to sell their properties will encounter increased competition, ‘Starmer Surge’ or no ‘Starmer Surge’, as more homes will be listed for sale in the coming months. The rise in mortgage rates has significantly impacted potential buyers’ incomes, reducing affordability and demand. This shift has led to price corrections in previously buoyant regions, especially in the south. Local factors such as reputable schools, amenities, and public services remain critical for prospective buyers.

Avoiding the Overpricing Trap

Some estate agents may advise homeowners to list their properties at inflated prices, only to suggest a price drop months later. Large estate agencies can afford to keep many homes listed unsold, whereas smaller agencies rely on consistent sales and tend to propose more realistic prices.

I’ve witnessed numerous Portsmouth homeowners being advised to place their properties on the market at elevated prices despite their reservations. Over time, with few viewings and no genuine offers, they reduce the asking price. This initial overpricing often results in prolonged waiting periods and missed opportunities to purchase desired homes. Homeowners may think they are immune to such tactics, but the allure of a higher valuation can be tempting.

It’s natural to want to price your Portsmouth home ambitiously. While dipping your toes in and testing the waters with a slightly higher price tag is perfectly understandable (a practice we occasionally employ at our agency after discussions with the home owner), refusing to adjust the asking price after a few weeks of minimal interest can be costly. An overpriced home can stagnate, leading potential buyers to suspect something is wrong with it. The longer it remains unsold, the more stigmatised it becomes.

A lack of early interest and viewings should be a clear signal to reconsider the asking price. Being responsive and proactive is crucial if there are no serious inquiries or offers within the first few weeks. By doing so, Portsmouth homeowners can avoid the traps of a stale listing and increase their chances of a successful sale and move.

The Current UK & Portsmouth Property Market Landscape

If one compares the number of UK homes sold year to date (YTD) in 2024 (459,682), it is 11.3% higher than the YTD net sales in 2023, yet it is 22.9% lower than the YTD figures in 2021.

However, when we look at the number of homes for sale today, there are 694,281 UK homes for sale compared to 481,242 UK homes for sale in May 2021 (44.3% lower).

Thus, the number of UK net homes sales is lower, yet the number of homes for sale is much higher. Delving deeper into the Portsmouth stats…

(Portsmouth area = PO1 to PO6).

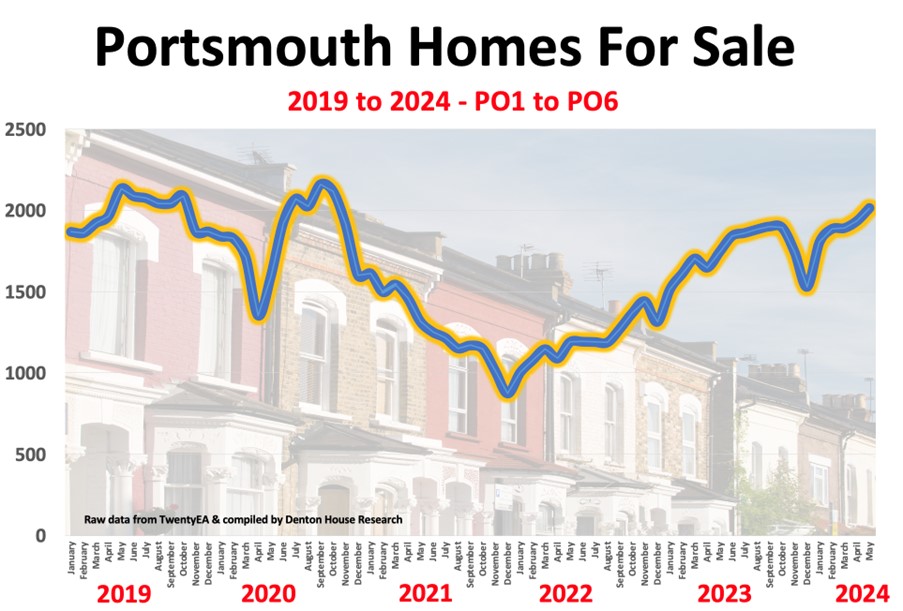

Roll the clock back to May 2019, there were 2,133 properties for sale in the Portsmouth area. One year on and the pandemic had hit, so the number of properties for sale reduced by 25.5% (to 1,590 Portsmouth homes for sale). Moving on to May 2021, and the number of Portsmouth homes for sale was now at 1,317 (which is 38.3% lower than the May 2019 number). However today, that figure now stands at 2,014, a substantial increase of 53% from the May 2021 numbers.

Remember that only 51.9% of the properties that have left UK estate agents books since the 1st of January 2024 have sold and completed (the remaining 48.1% came off the market, unsold). You can see that by only having an almost 50-50 chance of actually moving home if you put your house on the market, the importance of correctly pricing your home and having a great agent to market it is so essential (surge or no surge).

Determining the Right Price for your Portsmouth home

Portsmouth homeowners can arm themselves with valuable information about the local property market. Online platforms provide data on sold property prices in specific areas, offering benchmarks. £/sq.ft figures are vital to compare yourself against your competition. Additionally, the time properties spend on the market can provide insights into how efficient an estate agent is, with portals like Rightmove and Zoopla offering valuable data, plus my own Portsmouth property blog.

When selling, obtaining valuations and market appraisals from multiple agents and critically analysing them is essential. Agents should provide evidence to back their valuations, enabling homeowners to make informed decisions.

Rethinking the Selling Strategy

The Portsmouth property market tends to shift collectively, like boats on the same tide. The market remains manageable as long as homeowners aren’t facing financial losses and can manage an upgrade. Many assume continuous gains when selling their home, but real profit only materialises when one parts with your final property. This profit might not be realised directly but could be used later for care expenses or as a legacy for children or grandchildren.

Once a property is put on the market, it is crucial to focus on its online and offline marketing journey. The initial four weeks provide insights into whether the property is priced correctly, gauged by the number of web views on portals, actual viewings, and offers received. One strategy employed by some savvy Portsmouth home sellers is listing their property at a slightly lower price to spark more interest and drive up offers.

Deciding to reduce the listing price involves more than attracting buyers; personal timelines and goals play significant roles. For instance, is there a deadline by when the property must be sold? Could waiting a couple of months make a difference? These considerations help in making thought-out, informed decisions on asking price adjustments.

Boutique agents, like our agency in Portsmouth, can offer a more authentic experience and realistic valuations in a challenging market.

Switching Agents or Going Online?

In a slow property market, patience can wear thin. If considering switching agents, sellers should evaluate the current agent’s efforts and communication frequency. Multi-agency agreements are another option, though their popularity has declined recently due to higher associated fees.

Online agencies, with their fixed fees and remote operations, seem attractive. However, their one-size-fits-all model can fail to capture the nuances of individual properties, making them less effective in slower markets.

Renting as an Alternative

Renting out unsold properties is gaining traction as rents rise. However, prospective landlords should be cautious, considering growing mortgage interests, tax restrictions, and tenant-related challenges. If this is a potential option, do give our agency a call.

Final Thoughts

The current Portsmouth property market is complex. ‘Surge or No Surge’: It’s all about being realistic with your asking price. The freeze on the Bank of England base rates offers a welcome pause. While it won’t create a frenzy like the mid-2020 stamp duty holiday, any possible drop in the summer or early autumn will be a welcome respite.

With the right strategies and awareness, Portsmouth home sellers can effectively navigate these waters and ensure their property finds the right buyer at the right price.

If you are a Portsmouth property owner and this article has sparked any questions, do not hesitate to call our office.