The Conservative Government has gone on record with an ambitious plan to build 300,000 new homes each year from the mid-2020s (aspiring as the average for the last 13 years has only been 177,000 pa). So Downing Street see the planning system as requiring root and branch change to ensure local authorities deliver on that promise. The Ministry of Housing, Communities and Local Government’s ‘Housing Delivery Test’, which should be launched on an undetermined date this year, will hold local authorities to account for ensuring they hit their own specific house building targets.

If a local authority is unable to show that it has a five-year stock of land for building new homes, it gives builders greater rights and liberties to build their new homes where the builder wants (not where the local authority wants).

This will mean there will be a house building free-for-all

as the council will have less control over the setting, types of properties, contribution to infrastructure and location of any new home development.

Only 44% of local authorities have a local plan that is less than five years old.

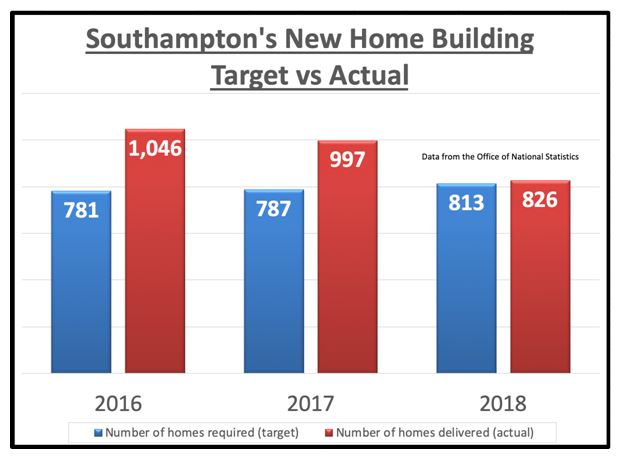

Locally, Southampton isn’t in that 44% of local authorities. The current situation is, a draft Local Plan is in preparation. Yet, the original question of this article was to find out if we are building enough homes in Southampton and the surrounding local authority area i.e. should we get the builders in? Well, the Government set targets for local authorities for the number of homes they should build each year. The latest set of data is for 2018, so for the three years up to and including 2018 i.e. 2016/2017/2018,

Southampton’s new home building target was 2,381 new homes, yet it achieved 2,869, a surplus of 488 new homes

So, what does that all mean for the Southampton property market?

Even with the surplus, there are positive and negatives to this. The Southampton property market is not broken, yet it does need to get the builders in. Irrespective of the results from the last three years, we have over three decades of under building, which has created issues regarding affordability of homeownership and older generations being stuck in homes too big because there aren’t enough suitable homes for them to move in to, i.e. bungalows. The stabilisation of the General Election has been a net positive to overall confidence in the local property market, meaning Southampton homeowners and Southampton landlords looking to sell their home in the coming spring and summer will find decent demand (although sellers still need to realistic with their pricing).

Unfortunately, the negatives are that many Southampton renters that want to buy, are unable to as they can’t save after paying their rents and feel as if they’ve been left behind. I know the Government recently launched their “First Homes” scheme for selected first time buyers at the start of February, where a 30% discount would apply to “a proportion of new homes” and would be subsidised out of contributions from builders, the Tory’s have previously promised to build 200,000 cut price homes for first time buyers back in 2015, yet the National Audit Office has recently confirmed they never built a single one!

The simple fact is, we as a country need to build far more affordable homes in the areas where people want them. This means the dream of homeownership will be a greater possibility for our children and grandchildren in the future. Our local authority needs to continue to plan the housing needs (and associated infrastructure) to ensure that as we live longer and continue to grow as a country – we have the homes to live in that are suitable for every generation.

CLICK HERE TO FIND OUT HOW MUCH YOUR SOUTHAMPTON PROPERTY IS WORTH

If you would like to pick my brains on the Southampton Property Market – pop in for a coffee or drop me a line on social media or email.

If you are looking for an agent that is well established, professional and communicative, then contact us to find out how we can get the best out of your investment property.

Email me on brian.linehan@belvoir.co.uk or call on 023 8001 8222.