In an age of sensational headlines, the UK property market—particularly in Southampton—often finds itself misinterpreted.

We cannot ignore the challenges of higher mortgage rates and shifting buyer preferences. It is vital to appreciate the broader context to understand what’s happening in the Southampton property landscape.

The UK housing market is currently at a junction. Is characterised by its lowest house price growth in 12 years and a rising number of homes for sale. Higher mortgage rates have made a sizable dent in market activity. It is affecting everything from buyer demand to the volume of property sales.

Don’t get us wrong, Southampton properties are still selling. But not at the rate or level they were in 2021. 15.1% more Southampton homes sold per month in 2024 compared to 2023.

Therefore, correctly pricing your Southampton property for sale cannot be underestimated. Let us explain the reasons behind the current state of play nationally. And, finally, the exact story of what is happening now (and in the future) in Southampton.

The Importance of Correctly Setting an Asking Price for Your Southampton Home

Putting your Southampton home on the open market at an asking price that is too high can considerably deter potential buyers. As well as limit the number of people who come to view it. Buyers always have a budget in mind. And if your property is priced above comparable homes in your area, it’s likely to be filtered out of search results and ignored.

Even if your property gets some attention, the inflated price can signal that you’re not serious about selling or unwilling to negotiate. This can result in your home languishing on the market, which could necessitate future price reductions.

Over time, buyers will begin to be suspicious that something must be wrong with your property. Irrespective of its high price.

Thus, setting a realistic, market-aligned asking price for your Southampton home is vital for attracting a broader pool of qualified buyers. Therefore facilitating a quicker, more lucrative sale with a higher chance of actually moving home.

Look at an analysis by TwentyEA and Denton House Research of the 1.1m house sales in the whole of 2023. If the property sells within the first 25 days of it going on the market, the chances of that sale agreed exchanging and completing is 94%. If it takes more than 100 days to achieve a sale, the chances of that sale subsequently exchanging and completing drops to 56%. Often because the initial asking price has been set too high and time is wasted.

The Impact of More Homes for Sale

The UK property market looks promising. Nationally, this year the number of properties sold (STC) was 1,045,620 (to the end of October). 8% higher than the same sales figure to the end of October 2023 (when it was 912,919).

However, there are 724,312 properties for sale in the UK. Which is 9.4% higher than at the same time in October 2023, when it was 662,829. It must also be remembered that the figure was 506,614 in October 2022 and 438,005 in October 2021.

There are 65.4% more homes for sale in the UK today compared to 3 years ago.

Just Only Half of all UK Homes Put on the Market, Sell and Move

Since 1st January 2024, of the 1,222,925 homes that left UK estate agents’ books. 654,081 (53.5%) exchanged and completed contracts (meaning the homeowner moved and the estate agent got paid). The remaining 568,844 (46.5%) were withdrawn from the market, unsold. In essence, you have a flip-of-the-coin chance of selling, and homeowners moving.

Focus on Southampton

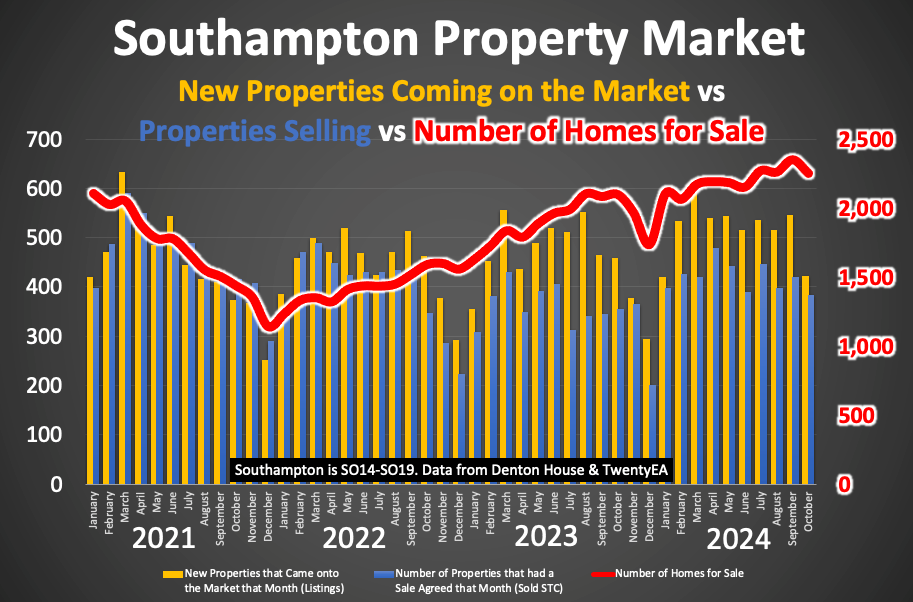

- In 2021, there were an average of 445 new Southampton properties coming onto the market. And 457 Southampton homes sold (STC) each month. The average number of homes for sale in 2021 was 1,691.

- In 2022, there were an average of 445 new Southampton properties coming onto the market. And 397 Southampton homes sold (STC) each month. The average number of homes for sale in 2022 was 1,438.

- In 2023, there were an average of 484 new Southampton properties coming onto the market. And 365 Southampton homes sold (STC) each month. The average number of homes for sale in 2023 was 1,867.

- 2024 YTD, there has been an average of 519 new Southampton properties coming onto the market. And 420 Southampton homes sold (STC) each month. The average number of homes for sale in 2024 was 2,200.

The volume of properties for sale in Southampton has increased by 30.1% over the past three years. This surge in available properties hasn’t significantly impacted house prices. It is likely the main reason Southampton house price growth has been kept in check.

With more Southampton homes on the market, local buyers now have greater choices and can be more discerning. This often leads to balanced negotiations, and so can moderate rapid house price increases. This dynamic ultimately benefits buyers and sellers, balancing the market and providing fair value across transactions.

Southampton = SO14-SO19.

The Costly Trap of Overvaluing: How It Could Affect Your Southampton Property Sale

Starting with a realistic asking price is the most sensible approach if you want to sell your property in Southampton. Overpricing, where the asking price is set too high, may be tempting. But it often leads to challenges that can delay your sale. Once a property is listed, it has a single chance to captivate buyers as a new instruction. Therefore bringing excitement and immediate interest. Miss that window with an overinflated price, and your dream home could slip through your fingers while you wait for a sale that never comes.

In Southampton, we’re seeing an increase in properties priced way above their actual market value. This is a trend often driven by estate agents focused more on the number of listings than on making actual sales. This approach can harm many Southampton homeowners. Setting their hopes high with a lofty price, only to later reduce it. Therefore losing valuable time and reducing the chances of actually selling their home and moving. This can be disheartening for many homeowners looking to move. Especially if it means missing out on another property they have their eye on.

Research from Which reveals that properties priced correctly from the outset sell faster and often achieve a better final price than those that start high and then undergo reductions. Overpricing by as much as 10 to 20% of your property’s actual value can leave it lingering on the market. Therefore losing the early buyer attention that often results in successful sales.

Further complicating the issue is that some estate agents incentivise their staff to prioritise listing properties rather than selling them pushing prices not in line with the market. With the Southampton property market stabilising, setting a realistic price has become even more crucial in attracting serious buyers and ensuring a timely sale.

Outlook for the Southampton Property Market

While dramatic house price rises aren’t anticipated in Southampton’s immediate future, there’s no significant drop expected either. Demographic and economic shifts—such as an ageing population, more flexible work arrangements, a strong labour market, and sustained immigration—could contribute to renewed market activity in the coming years. Additionally, base rates are expected to dip below 3.5% by the end of 2025. Likely impacting buyer behaviour more noticeably next year.

The British property market faces some challenging conditions.

With effects of the budget still to be seen and those fuller mortgage rates affecting affordability. However, the trend of above inflation pay rises that we have seen in the Country over the last 12 months could make homeownership more accessible for many more people in the medium to long term. However, combined with a potential drop in mortgage rates in 2025, wages continuing to outstrip inflation and demographic shifts, these changes could encourage an even healthier and more balanced property market in the next 12 months?

Understanding these trends helps both Southampton buyers and sellers make more informed decisions. Though the market may seem under strain now, Southampton homeowners who set realistic asking prices will be in a strong position as the market looks to become more accessible in the near future.

If you’re in Southampton and considering a move, reach out for a free, no-obligation valuation or market appraisal of your home. I aim to get the best possible price for your property, with advice tailored to give you the greatest chance of a successful sale in today’s market.

Stats from Land Registry, ONS, TwentyEA , Denton House Research