Yet is it a sellers’ market in St Helens?

The number of agreed UK property sales until the last Sunday of January (28th) is 8.35% higher than a year ago. Tumbling mortgage costs have encouraged buyers and sellers to return to the property market.

There is a more buoyant picture for the UK property market in the first four weeks of January 2024 compared with the same first four weeks in 2023.

Every UK region has seen an increase in the number of properties selling (subject to contract) in January 24 vs January 23; the most significant rise was found in Inner London, which was up 25.14% year-on-year, followed by the South East, at 20.02%, the South West at 16.18%. Most other regions (West Midlands, Outer London, North West, Yorkshire, Ulster, East Anglia, Wales, East Midlands & North East) increased by between 12% and 15%. The smallest rise was in Scotland at 4.45%.

As well as increased property sales, the supply of UK properties on the market is 13.95% higher than a year ago

(592,574 for sale in January 2024 versus 519,987 for sale in January 2023)

According to Zoopla, London experienced the most significant rise in potential buyer interest, with a 21% uptick in new buyer inquiries in the capital during the initial three weeks of January compared to last year. This surge was the highest recorded across all UK regions, significantly surpassing the national average increase of 12%.

Net sales (sales agreed less sale fall throughs) paint an

even better picture, with a rise of 14.8%

(55,459 net UK home sales to January 28th 2024, compared to 48,325 net UK home sales to January 28th 2023)

Growing optimism is evident among prospective buyers and sellers as mortgage interest rates, which saw a significant rise in 2023, have started to fall in the last month or so. By the end of December, inflation had fallen to 4%, down sharply from a peak of 11.1% in October 2022 and considerably lower than the Bank of England’s anticipated 4.6%. Additionally, the average mortgage rates have dipped to their lowest point since early June, with some banks & building societies reducing mortgage rates to below 4% (for those with large deposits).

Even with this upswing in property market activities, price levels are likely to remain stable, and the market will continue to favour buyers due to ongoing mortgage affordability issues and the still relatively high-interest rates.

The reduction in mortgage rates has undoubtedly rejuvenated buyer interest and transactions, particularly after a slowdown in the latter half of 2023, when many prospective movers paused their plans. This resurgence is expected to help increase the number of properties sold, which, at one million, were at an 11-year low in 2023.

However, I cannot see this trend leading to a significant increase in house prices in 2024 since the market remains finely balanced with a medium-term drift towards a slightly weaker sellers’ market for Q2/Q3 in 2024 (compared to 2021, when it was an extreme sellers’ market). Sellers eager to move in 2024 might find encouragement in these initial signs of increased activity. Still, the buyer’s focus on value means that any undue optimism on the part of sellers could hold back the current property market recovery.

There are also warnings that the uncertainties often associated with a general election year inhibit the property market, as buyers and sellers become more cautious in their decisions in the lead up to voting at the polls.

This is the time to be realistic with your pricing if you’regoing to put your St Helens home on the market

So, what sort of market are we in?

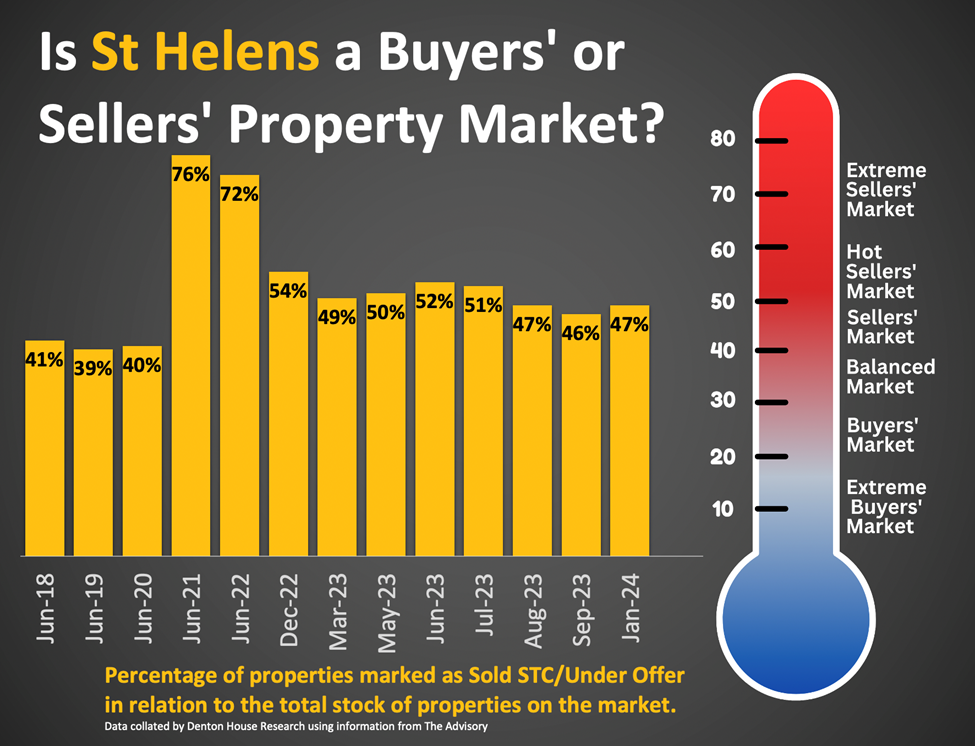

The measurement of whether it’s a buyers’, balanced or sellers’ market is based on the proportion of properties marked as “Sold STC” and “Under Offer” compared with the total number of properties on the market, e.g., if there are 45 properties sold stc and 100 properties available/for sale, then 45 as a percentage of 100 is 45%.

This isn’t just a numbers game; it’s a gauge of market sentiment:

- Extreme Buyers’ Market (0%-20%)

- Buyers’ Market (21%-29%)

- Balanced Market (30%-40%)

- Sellers’ Market (41%-49%)

- Hot Sellers’ Market (50%-59%)

- Extreme Sellers’ Market (60%+)

The weight of these brackets can’t be overstated. They directly impact everything from listing prices to negotiation leverage.

Current St Helens Property Market Snapshot

To calculate where St Helens’ property market stands now, let’s incorporate our most recent findings for January 2024. The numbers and statistics have been taken from the website ‘The Advisory’, which has calculated the market state stats for many years. I am sharing them from the summer of 2018 to January 2024.

What are the Statistics for the St Helens Area Since 2018?

Looking at each of the St Helens postcode districts, each tells its own story…

| Jun-18 | Jun-19 | Jun-20 | Jun-21 | Jun-22 | Dec-22 | Mar-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Jan- 24 | |

| WA9 | 38% | 37% | 39% | 72% | 73% | 53% | 47% | 48% | 52% | 49% | 45% | 44% | 43% |

| WA10 | 36% | 37% | 35% | 73% | 68% | 50% | 50% | 52% | 54% | 52% | 49% | 45% | 45% |

| WA11 | 48% | 43% | 45% | 82% | 75% | 58% | 49% | 49% | 49% | 52% | 48% | 48% | 54% |

The average of all the St Helens postcode districts combined was quite clearly an extreme sellers’ market in the summer of 2021 at 76%. In 2023, the St Helens property market changed, and it went from early 50%, a hot sellers’ market, to late 40%, a sellers’ market. In January 2024, it remained in a sellers’ market.

Consequences and Thoughts for St Helens’ Property Market

This new data prompts me to take stock and ponder.

For St Helens home sellers: We are transitioning into a market where sellers must be more strategic, flexible, and patient. It would help if you braced yourself to expect your home to be on the market for longer with an extended marketing period.

Realistic pricing is even more vital than ever.

In 2022, for 72.1% of St Helens properties that came onto the market, the owner moved (i.e., exchanged and completed) instead of withdrawing off the market, unsold. In 2023, that figure had reduced to 60.5%, (interesting, when compared with the national picture when it was 65.33% in 2022 and 52.86% in 2023).

For St Helens home buyers: What are the challenges and opportunities? Some homes will still have bidding wars, yet you will have the luxury of choice and time with others.

External influences, from global economic trends, inflation and interest rate repercussions could all cast shadows on the St Helens property market. The pre-election Budget will no doubt affect the property market as will everything going on ice in the three or four weeks up to the election itself.

Delving Deeper: Strategies and Tactics to Sell Your St Helens Home

Given the property market’s temperature, here are more granular insights:

Sellers: I’ve already mentioned, pricing is absolutely key to finding the right buyer. Also, the marketing to make your home stand out is vital – like video/virtual tours or social media—could make a difference in a cooling market.

Buyers: Again, there is more than one market (look at the differences between the St Helens postcode districts above). The competition will heat up if you are looking for the type of property everyone wants. Having your mortgage pre-approval in place will give you an advantage over other buyers. Also, it is worth being open to widening your search radius to spot bargains others could miss. On the other hand, St Helens home buyers can exert more power in negotiations in a less competitive market, from offer price to extras (e.g. carpets or fixtures and fittings). Don’t forget –

81% of sellers are also buyers. So, what you might lose fromselling in a buyers’ market means you gain when buying

Final thoughts – as we enter the second month of 2024, the St Helens property market offers both challenges and opportunities for St Helens’ home buyers and sellers. Understanding the market nuances is vital if you are a St Helens first-time buyer, an existing homeowner looking to move, a seasoned property buy-to-let investor, or someone looking to relocate.

Stay adaptable, stay informed and remember that, as always, your home-moving story is as much about the journey as the destination.

What are your thoughts on St Helens’ evolving property scene? Do you anticipate any other trends or shifts in the St Helens property market? What are your local insights and experiences?

Stats from TwentyEA, The Portals & Denton House Research