Are you a St Helens homeowner? Are you thinking of moving home in the next six to twelve months? Whether you’re aiming to buy your dream St Helens home or sell a beloved property, grasping the current market dynamics is crucial.

You might be a St Helens buy-to-let landlord, possibly looking at selling or buying another property to add to your portfolio?

Also, you could be a St Helens first-time buyer and wondering if this is a good time to buy or not?

Irrespective of which of these you are, understanding whether the St Helens property market favours buyers or sellers is crucial for making informed decisions.

By examining the local St Helens property market, we can gauge current trends, prices, and opportunities, allowing all parties – buyers, sellers, investors, and first-time homeowners – to strategically plan their next moves.

What Sort of St Helens Property Market are We In?

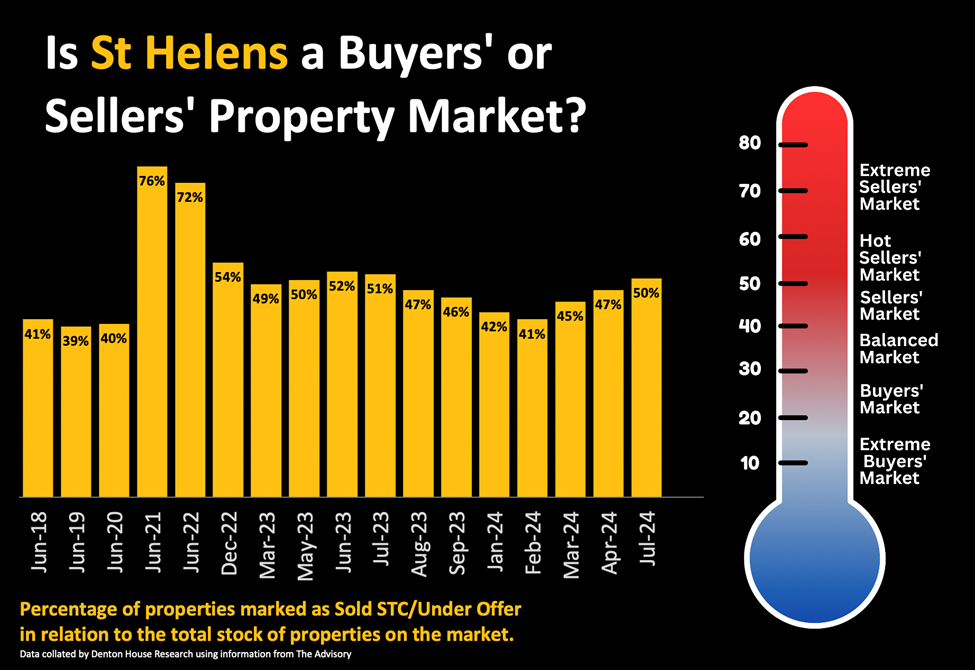

Those of you that regularly follow my St Helens Property Market blogs, know the measurement of whether it’s a buyers’, balanced, or sellers’ market is based on the proportion of properties marked as “Sold STC” and “Under Offer” compared with the total number of properties on the market.

For example, if there are 46 properties sold STC and 100 properties available/for sale, then 46, as a percentage of 100, is 46%.

This isn’t just a numbers game; it’s a gauge of market sentiment:

- Extreme Buyers’ Market (0%-20%)

- Buyers’ Market (21%-29%)

- Balanced Market (30%-40%)

- Sellers’ Market (41%-49%)

- Hot Sellers’ Market (50%-59%)

- Extreme Sellers’ Market (60%+)

The significance of these brackets can’t be overstated. They directly impact everything from listing prices to negotiation leverage.

Current St Helens Property Market Snapshot

To calculate St Helens’ property market’s status, let’s incorporate our most recent findings for July 2024. The numbers and statistics have been taken from the website ‘The Advisory,’ which has calculated the market state for many years. I am sharing them from the summer of 2018 to July 2024.

- The St Helens postcode districts of WA9/10/11 combined showed an extreme sellers’ market at 76% in the summer of 2021, which eased off throughout 2022.

- Throughout 2023, the St Helens property market was in the 40% and 50% range (both a sellers and a hot sellers’ market). As expected, due to the seasonal nature of the property market, by January 2024 this had reduced to 42%.

- Since January 2024, it has been increasing, and now stands at 50%.

The Consequences and Thoughts for St Helens’ Property Market

This new data prompts me to take stock and ponder.

For St Helens sellers: We are now in a property market where sellers must be more strategic, flexible, and patient. You should brace yourself for your home to be on the market for longer, with an extended marketing period. Realistic pricing is more vital than ever. Setting the right price is crucial for attracting suitable buyers.

Why? Because your chances of selling your St Helens home have dropped in the last few years.

For all the St Helens homes that left estate agent books in the 12 months between July 2022 and June 2023, 64.99% of St Helens homes sold and completed (the rest withdrawing, unsold). Since 1st January 2024, that figure for St Helens homes has dropped to 57.24%.

(Just for comparison, for all the homes that left estate agent books in the 12 months between July 2022 and June 2023, 58.67% of UK homes on the market sold and completed. Since 1st January 2024, that figure for UK homes has also dropped to 51.13%).

Therefore, your marketing strategy is just as important. Employing tools such as video or virtual tours, targeted social media campaigns, or interactive property listings could be particularly beneficial in this more ‘normal’ market of 2024.

For St Helens buyers: Expect intense competition if you’re interested in highly sought-after types of properties. Securing mortgage pre-approval can put you ahead of other prospective buyers. Consider expanding your search area to discover potential deals that others may overlook. Conversely, in less competitive markets, St Helens buyers have more leverage to negotiate from the offer price to inclusions like carpets, fixtures, and fittings. You will also have the luxury of choice and time with other homes.

Remember, four out of five sellers are also buyers, so what you may lose on the sale might be compensated for on the purchase. External influences such as global economic trends, inflation, and interest rate repercussions could all cast shadows on the St Helens property market.

Final Thoughts

As we progress into the eighth month of 2024, the St Helens property market presents challenges and opportunities for buyers and sellers.

Understanding these market subtleties is crucial for anyone considering a move, from existing homeowners to seasoned buy-to-let investors, first-time buyers, or those looking to relocate to St Helens.

Stay flexible, stay informed, and remember that your home-moving experience is as much about the journey as the destination.

What are your thoughts on St Helens’ developing property market since we have a new Government?

Do you anticipate any other shifts or trends in the St Helens property market?

What are your local insights and experiences?

Please do share them.

THE STATS

Stats from The Advisory, Portals, TwentyEA , ONS & Denton House Research