The British Property Federation (BPF) states that the Private Rented Sector (PRS) will require 225,000 new homes each year to 2025.

Price Waterhouse Cooper (PWC) residential research estimates that 7.2 million households will be in Private Rented Homes by 2025 compared to 5.4 million today, a 33% increase in 7 years.

The PRS sector offers stable long-term income with the opportunity for rental growth

The Midlands offers opportunities in good quality secondary towns and cities for PRS.

Knight Frank recent PRS briefing update and data from August 2017 highlights the sector potential which shows gross yields in Birmingham at 4.25%.

Secondary Regional Cities within the Midlands are identified within the market segment as positive investment, see Knight Frank Capital Markets at Annex A targeting 5% gross yields.

Potential to purchase new build homes with low asset management costs in the early years.

One of the many advantages of entering the PRS market now is the lack of development in recent years, offering the potential to establish dominance and attract tenants from older existing housing stock, which is often outmoded and bettered by new, purpose built PRS initiatives.

Belvoir project with properties professionally managed by award winning specialist letting agents. Industry leading marketing, compliance and legal expertise within The Property Ombudsman’s regulatory requirements.

The Belvoir PRS initial investment plan has identified build to rent opportunities within key growth towns and cities in the Midlands.

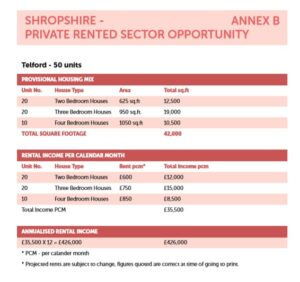

A Telford scheme of 150 plots with a home design mix of apartments and 2, 3 and 4 bedroom houses is available with the opportunity to phase any acquisition with an initial purchase of circa 50 homes, see Annex B. The usual building warranties will be provided.