Property investment has long been a staple in British retirement planning.

The introduction of the buy-to-let mortgage over a quarter-century ago marked a significant turn, presenting opportunities for dual returns: rental income in the short term and capital growth in the long-term. You can see why there are a substantial number of Warrington landlords who view property investment as a cornerstone of their retirement strategy.

However, this path is full of challenges. Recent shifts in tax and regulatory landscapes, coupled with escalating interest rates, have imposed pressures on profitability, compelling some landlords to reconsider their positions. Thus, becoming a landlord in Warrington necessitates meticulous research and a strategic approach.

𝗧𝗵𝗲𝗙𝗼𝘂𝗻𝗱𝗮𝘁𝗶𝗼𝗻𝘀𝗼𝗳𝗕𝘂𝘆–𝘁𝗼–𝗟𝗲𝘁𝗠𝗼𝗿𝘁𝗴𝗮𝗴𝗲𝘀𝗶𝗻𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻

A critical step in this venture is securing a buy-to-let mortgage, a process distinct from obtaining a homeowner loan. Lenders assess buy-to-let applicants based on an interest-coverage ratio (ICR), which demands that rental income meets or exceeds a certain percentage of the monthly mortgage interest (a minimum of 125% for standard taxpayers and 145% for higher-rate taxpayers). Additionally, many lenders require that buy-to-let borrowers have a minimum annual income outside of rental earnings to mitigate dependence on rental income.

Regarding the initial investment, a typical deposit hovers around 25% of the property’s value. The borrowing landscape has experienced upheavals with the Bank of England’s recent base rate increases. However, the average rate for a five-year fixed buy-to-let mortgage has witnessed a reduction in rates recently. For example, at the time of writing, HSBC has a 5-year BTL mortgage at 4.84% with a 75% Loan to Value (i.e. you put down a 25% deposit) with an arrangement fee of £1,999. Prospective Warrington landlords must judiciously consider these factors, evaluating the sustainability of their investment against potential interest rate hikes.

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴𝗖𝗼𝘀𝘁𝘀𝗮𝗻𝗱𝗣𝗿𝗲𝗽𝗮𝗿𝗮𝘁𝗶𝗼𝗻𝘀

The financial commitment extends beyond the deposit. Prospective landlords in Warrington should account for additional expenses like stamp duty, which includes a 3% surcharge for second homes. Furthermore, maintaining a contingency fund for maintenance and unforeseen rental voids is prudent. It’s advisable to earmark approximately 1% of the property’s value annually for repairs and upkeep.

𝗡𝗮𝘃𝗶𝗴𝗮𝘁𝗶𝗻𝗴𝘁𝗵𝗲𝗕𝘂𝘆–𝘁𝗼–𝗟𝗲𝘁𝗟𝗮𝗻𝗱𝘀𝗰𝗮𝗽𝗲

Investment in Warrington buy-to-let properties is not merely a financial decision but also an emotional one. Landlords must be prepared for the demands of property management, ranging from addressing maintenance issues to dealing with tenant-related challenges. The complexity of landlord responsibilities is underscored by over 150 pieces of legislation governing the sector, a figure poised to rise with impending regulations.

𝗗𝗲𝗺𝗮𝗻𝗱 & 𝗦𝘂𝗽𝗽𝗹𝘆𝗼𝗳𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗥𝗲𝗻𝘁𝗮𝗹𝗣𝗿𝗼𝗽𝗲𝗿𝘁𝗶𝗲𝘀

The Warrington rental market has experienced a sustained period of significant rental inflation over the past few years. Despite that, Zoopla recently stated that demand for rental properties on its portal was 51% higher in Q3 2023 than the five-year average.

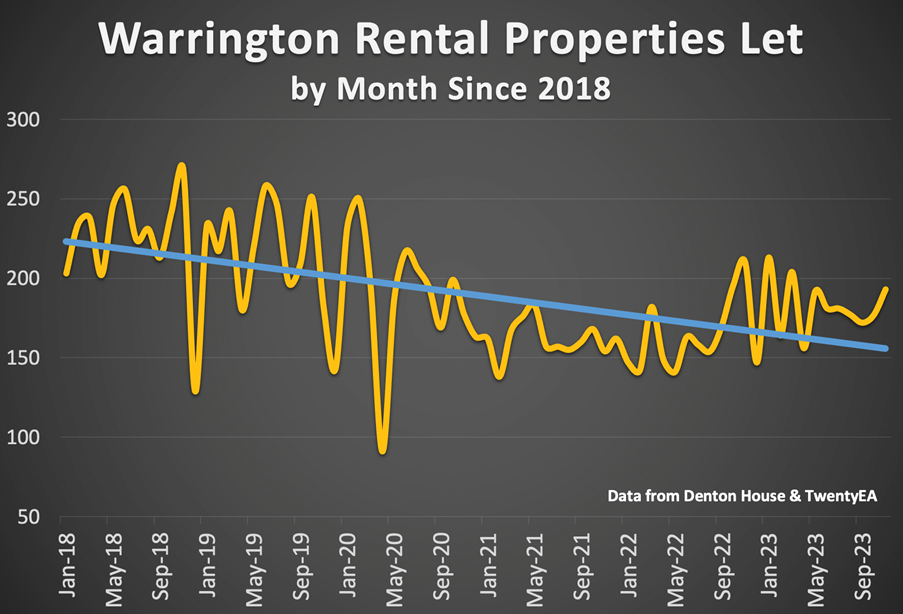

In the Warrington area (WA1 to WA5), the numbers of properties being let over the last six years are as follows.

In 2018, an average of 224 properties were let per month in the Warrington area.

In 2019, an average of 215 properties were let per month in the Warrington area.

In 2020, an average of 190 properties were let per month in the Warrington area.

In 2021, an average of 162 properties were let per month in the Warrington area.

In 2022, an average of 163 properties were let per month in the Warrington area.

In 2023, an average of 183 properties were let per month in the Warrington area.

However, even though demand is higher, the long-term supply of rental properties coming onto the market in the Warrington area has dropped.

So, we have increased demand and reduced supply, which can only mean rents will continue to grow as they have for the last couple of years.

This ongoing imbalance between supply and demand is a consistent characteristic of the rental market throughout all regions and countries in the UK. Currently, the annual rent growth rate in the UK stands at just over 10%. It’s not good news for tenants, yet it still makes buy-to-let financially viable for most Warrington landlords, especially as interest rates have risen significantly in the last few years.

𝗥𝗲𝗻𝘁𝗔𝗱𝗷𝘂𝘀𝘁𝗺𝗲𝗻𝘁𝘀𝗮𝗻𝗱𝗧𝗲𝗻𝗮𝗻𝘁𝗥𝗲𝗹𝗮𝘁𝗶𝗼𝗻𝘀𝗶𝗻𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻

For landlords, understanding the regulations surrounding rent increases is crucial. These rules vary depending on the tenancy type, with periodic tenancies allowing for annual rent reviews. Ensuring transparent communication and fair practices in rent adjustments can foster harmonious landlord-tenant relationships.

𝗧𝗵𝗲𝗘𝘃𝗶𝗰𝘁𝗶𝗼𝗻𝗣𝗿𝗼𝗰𝗲𝘀𝘀: 𝗔𝗗𝗲𝗹𝗶𝗰𝗮𝘁𝗲𝗠𝗮𝘁𝘁𝗲𝗿

Eviction is a process governed by strict legal parameters. The anticipated changes in the Renters’ Reform Bill, particularly concerning Section 21 evictions, are set to alter the landscape, emphasizing tenant protection. Landlords must be well-versed in these regulations to navigate tenant eviction legally and ethically.

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻: 𝗧𝗵𝗲𝗥𝗼𝗹𝗲𝗼𝗳𝗘𝘅𝗽𝗲𝗿𝘁𝗶𝘀𝗲𝗶𝗻𝗣𝗿𝗼𝗽𝗲𝗿𝘁𝘆𝗜𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁

Having a knowledgeable and experienced guide is invaluable in the intricate world of property letting. As a seasoned agent in Warrington, I offer a wealth of expertise and insight, making me and my team an ideal partner for both novice and experienced landlords.

Whether navigating the complexities of buy-to-let mortgages, understanding the nuances of property investment in Warrington, or managing tenant relationships, our proficiency is a vital resource for anyone looking to explore or deepen their involvement in the property market.

In conclusion, the journey to becoming a landlord, especially in a market like Warrington, rewards careful planning, informed decision-making, and strategic foresight. With the guidance of seasoned professionals like us, Warrington landlords can navigate the challenges and complexities of the property market, ensuring their investment not only endures but thrives.