The UK’s property market is facing a significant challenge as the availability of homes for rent has plummeted to its lowest level in five years, exacerbating the difficulties tenants face in finding affordable accommodation.

This alarming trend was highlighted in a recent analysis, which revealed that in 2023, only 261,542 private rental homes were available per month in the UK, marking a steep decline from the 379,459 monthly average of rental homes available in 2020 – a drop of 31%, underscoring a worrying trend that has been developing over recent years.

𝗧𝗵𝗶𝘀𝘀𝗰𝗮𝗿𝗰𝗶𝘁𝘆𝗼𝗳𝗿𝗲𝗻𝘁𝗮𝗹𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝗶𝗲𝘀𝗶𝘀𝗼𝗰𝗰𝘂𝗿𝗿𝗶𝗻𝗴𝗮𝗴𝗮𝗶𝗻𝘀𝘁𝗮𝗯𝗮𝗰𝗸𝗱𝗿𝗼𝗽𝗼𝗳𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴𝗺𝗼𝗿𝘁𝗴𝗮𝗴𝗲𝗰𝗼𝘀𝘁𝘀𝗳𝗼𝗿𝗹𝗮𝗻𝗱𝗹𝗼𝗿𝗱𝘀, 𝘄𝗵𝗶𝗰𝗵, 𝗶𝗻𝘁𝘂𝗿𝗻, 𝗽𝗹𝗮𝗰𝗲𝘀𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹𝗽𝗿𝗲𝘀𝘀𝘂𝗿𝗲𝗼𝗻𝘁𝗵𝗲𝗿𝗲𝗻𝘁𝗮𝗹𝗺𝗮𝗿𝗸𝗲𝘁.

Higher interest rates, coupled with a high demand for rental properties, have led to significant increases in rental prices (rising from £1,343 pcm in 2020 to £1,739 pcm in 2023 – an increase of 29%), making it increasingly difficult for tenants to find affordable housing.

The combination of reduced availability and escalating costs creates a challenging environment for renters, finding fewer properties available at higher rents.

The difficulties tenants face are further compounded by the financial pressures on mortgaged landlords, who have seen the affordability of mortgages decline sharply. This has led to a re-evaluation of their business models by some landlords, with a resultant divestment from rental property portfolios in some cases. The impact of this on the market has been profound, with average buy-to-let mortgage rates experiencing a sharp increase, further exacerbating the challenges landlords and tenants face.

𝗧𝗵𝗲𝗨𝗞𝗿𝗲𝗻𝘁𝗮𝗹𝗺𝗮𝗿𝗸𝗲𝘁‘𝘀𝗱𝘆𝗻𝗮𝗺𝗶𝗰𝘀𝗵𝗮𝘃𝗲𝘀𝗵𝗶𝗳𝘁𝗲𝗱𝘀𝗶𝗴𝗻𝗶𝗳𝗶𝗰𝗮𝗻𝘁𝗹𝘆, 𝘄𝗶𝘁𝗵𝗿𝗲𝗻𝘁𝘀𝗿𝗶𝘀𝗶𝗻𝗴𝗯𝘆𝟮𝟵% 𝗮𝘀𝗮𝘃𝗮𝗶𝗹𝗮𝗯𝗹𝗲𝗿𝗲𝗻𝘁𝗮𝗹𝘀𝘁𝗼𝗰𝗸𝗱𝘄𝗶𝗻𝗱𝗹𝗲𝗱𝗯𝘆𝟯𝟭% 𝘀𝗶𝗻𝗰𝗲𝟮𝟬𝟮𝟬.

The Bank of England has highlighted the potential repercussions of this situation in its financial stability report in the summer of 2023, noting that many landlords are likely to seek a raise in rents to offset their higher costs as they come off their fixed-rate mortgages, thereby exacerbating the difficulties for tenants, particularly those with lower incomes and lower savings.

The supply crunch in the rental market has led to increased competition among prospective tenants, with many properties being let almost immediately to quality tenants. This competition drives rents upwards, making it even more challenging for new tenants to find affordable housing. Additionally, the reluctance of existing tenants to move, fearing higher rents elsewhere, contributes to the shortage of available properties, as fewer tenancies are ending and coming back onto the market.

This situation is particularly acute at the lower end of the price spectrum, where the availability of homes to rent for less than £1,000 a month has significantly declined, making it even more challenging for those on tighter budgets to find suitable housing.

𝟳𝟰𝟬,𝟬𝟮𝟳𝘀𝘂𝗯 £𝟭,𝟬𝟬𝟬𝗽𝗰𝗺𝗨𝗞𝗿𝗲𝗻𝘁𝗮𝗹𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝗶𝗲𝘀𝗰𝗮𝗺𝗲𝗼𝗻𝘁𝗼𝘁𝗵𝗲𝗺𝗮𝗿𝗸𝗲𝘁𝗶𝗻𝟮𝟬𝟮𝟬; 𝘁𝗵𝗶𝘀𝗱𝗿𝗼𝗽𝗽𝗲𝗱𝘁𝗼𝟰𝟲𝟰,𝟳𝟳𝟰𝗶𝗻𝟮𝟬𝟮𝟯, 𝗮𝗱𝗿𝗼𝗽𝗼𝗳𝟯𝟳.𝟮%.

In contrast, the market for premium properties (over £2,000 pcm) has seen an increase in availability of 52.6% (from 203,502 coming on the rental market in 2020 to 310,516 in 2023), highlighting the stark disparities within the rental market.

The implications of this trend are far-reaching, affecting not only those currently looking to rent but also the broader housing market and the economy.

𝗛𝗼𝘄𝗶𝘀𝘁𝗵𝗶𝘀𝗮𝗻𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆𝗳𝗼𝗿𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗹𝗮𝗻𝗱𝗹𝗼𝗿𝗱𝘀?

The current property market could present a notable opportunity for Warrington landlords. To do that, we must look at the background statistics and numbers for the Warrington area.

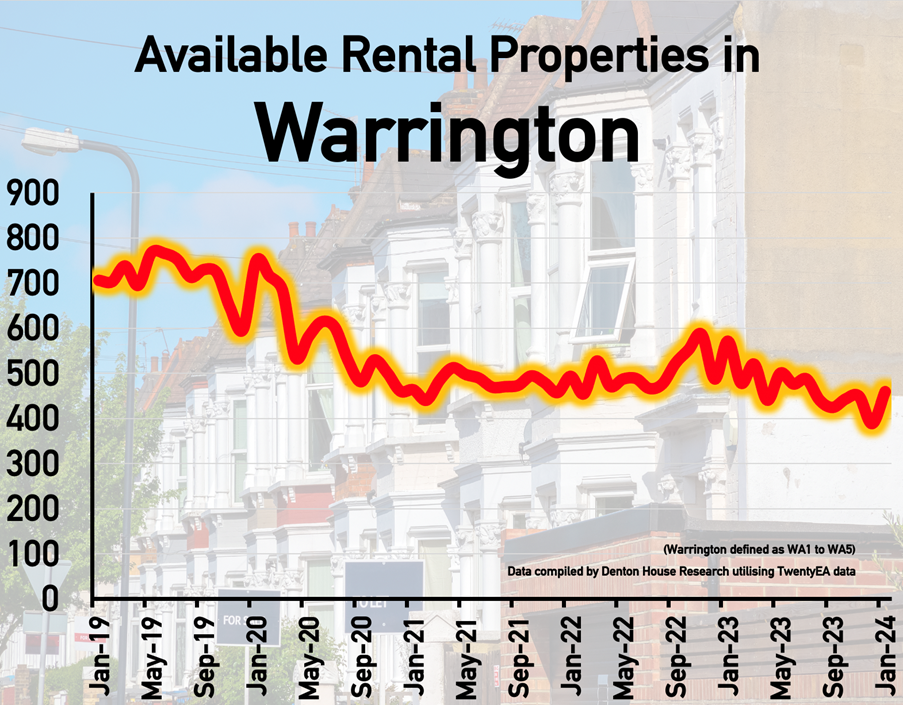

These are the average monthly stock levels of private rental homes in the Warrington area (WA1 to WA5) …

- 2019 – 711 rental properties per month in the Warrington area

- 2020 – 582 rental properties per month in the Warrington area

- 2021 – 477 rental properties per month in the Warrington area

- 2022 – 501 rental properties per month in the Warrington area

- 2023 – 467 rental properties per month in the Warrington area

The average rent in the Warrington area in 2020 was £678 per calendar month; in 2023, it was £951 per calendar month.

𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗿𝗲𝗻𝘁𝘀𝗵𝗮𝘃𝗲𝗿𝗶𝘀𝗲𝗻𝗯𝘆𝟰𝟬%, 𝗮𝘀𝗮𝘃𝗮𝗶𝗹𝗮𝗯𝗹𝗲𝗿𝗲𝗻𝘁𝗮𝗹𝘀𝘁𝗼𝗰𝗸𝗱𝘄𝗶𝗻𝗱𝗹𝗲𝗱𝗯𝘆𝟭𝟵% 𝘀𝗶𝗻𝗰𝗲𝟮𝟬𝟮𝟬.

The escalation of rental prices signifies a robust income stream for Warrington property investors. This is particularly advantageous in a market where high demand ensures properties are let swiftly, often to quality tenants willing to pay a premium for scarce housing options. For Warrington landlords, this means not only an immediate increase in rental income but also the prospect of sustained long-term profitability as market dynamics push Warrington rents even higher.

Furthermore, the challenging mortgage landscape, with rising buy-to-let mortgage rates with high percentage mortgages, has meant more landlords leaving the market, thereby reducing competition and potentially increasing the demand for existing Warrington rental properties even further.

This unique set of circumstances presents an opportune moment for current and prospective landlords to capitalise on their Warrington property investments, leveraging the tight supply to secure higher rental yields and enhance the attractiveness of their property portfolios.

𝗪𝗵𝗮𝘁𝗮𝗯𝗼𝘂𝘁𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝘁𝗲𝗻𝗮𝗻𝘁𝘀?

As the UK grapples with this challenging rental market landscape, a multifaceted approach is needed to address the underlying issues. This includes considering the impact of mortgage costs on landlords, the affordability of rents for tenants, and the overall availability of rental properties.

The Government need to build more homes. Yet excluding land, the building costs in the UK start from £163 per square foot. A 3-bed semi is a minimum of 1000 ft.². The most conservative estimate shows that Britain is approximately 2 million households short now, meaning the bill for those additional 2 million homes would be £326bn (excluding the land). For context, the NHS costs £181bn a year!

The Government currently spends £17.35bn a year on housing, which would need to increase to £49bn a year for the next ten years to pay for those 2 million homes. To give you an idea of what that would cost taxpayers …

𝗜𝗻𝗰𝗼𝗺𝗲𝘁𝗮𝘅𝘄𝗼𝘂𝗹𝗱𝗻𝗲𝗲𝗱𝘁𝗼𝗿𝗶𝘀𝗲𝗯𝘆𝟱.𝟴𝟭𝗽𝗲𝗻𝗰𝗲𝗶𝗻𝘁𝗵𝗲𝗽𝗼𝘂𝗻𝗱𝘁𝗼𝗽𝗮𝘆𝗳𝗼𝗿𝘁𝗵𝗼𝘀𝗲𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹𝟮𝗺𝗶𝗹𝗹𝗶𝗼𝗻𝗵𝗼𝗺𝗲𝘀!

That is the equivalent of an extra £991 per year for every taxpayer for the next ten years – not a vote winner! Yet without significant Government intervention and strategic planning, the difficulties tenants face in finding affordable homes will likely persist, with potential long-term implications for the housing market and the broader economy.

Meanwhile, British landlords must pick up the pieces and continue to buy properties. Unfortunately, it is the nature of the game that with limited supply and increasing demand, prices (i.e., rents) go up. My heart goes out to Warrington tenants having to pay these increased rents, but the market is the market, and we cannot control that. It has been proved beyond doubt, in Scotland and around the world, that rent controls do more harm than good, so I hope that the Government grasps the nettle and finally does something to sort our housing issues once and for all in the medium to long term.

Please do give me your thoughts on the matter.